AI entanglements: Balancing risks and rewards of European-Chinese collaboration

This report was made possible by the support of the German Federal Foreign Office.

Click here for more information on MERICS standards to maintain independence in research and editing.

Key findings

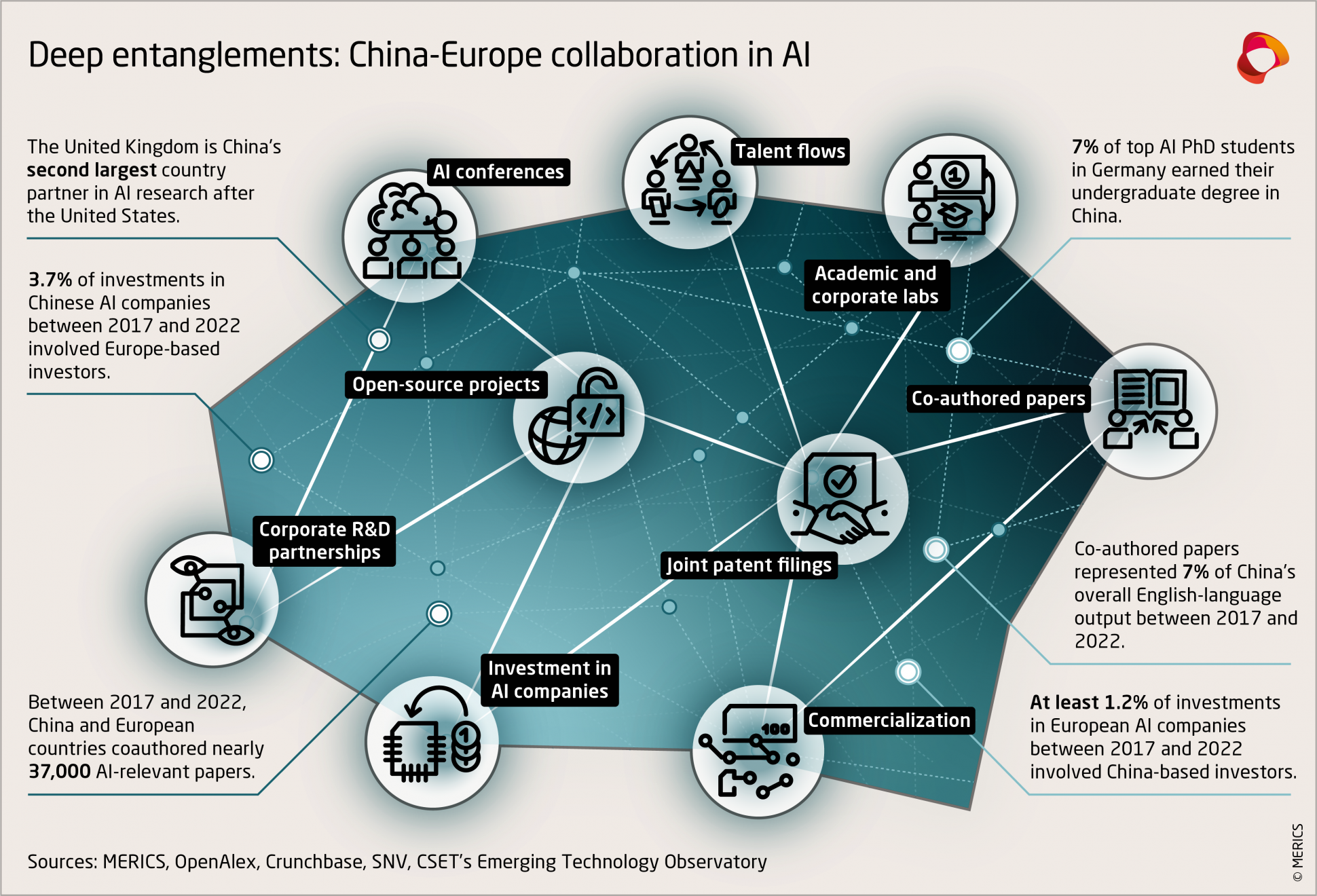

- AI collaboration between Europe and China is taking place against the backdrop of intensifying economic, technological, and geopolitical competition. To remain competitive in AI innovation, foster the right kinds of collaboration, and assess risks, Europe’s policymakers need to have a better picture of the existing R&D and commercial ties.

- China and Europe are becoming more important AI research partners. Between 2017 and 2022, we identified nearly 37,000 English-language, AI-relevant joint research papers. European-Chinese collaborations’ share in total European output doubled while their share in China’s body of English-language AI research grew more slowly. China’s government is by far the most frequent disclosed funder.

- The United Kingdom stands out in its research ties with China, with almost half of all collaborative papers in our dataset. In 2021, 21 percent of its entire AI research output comprised papers co-authored with Chinese partners, which may indicate an uneven dependency in terms of talent and knowledge production.

- Many European-Chinese AI research outputs have military or surveillance applications. These include, among others collaborations on target tracking, cybersecurity and biometric recognition with risky entities in China. European researchers should consider the prospective partners, the specific research, and its potential end-uses.

- Technology and knowledge transfer with China is more of a two-way street as it becomes a top player in AI research. Europe has a clear interest in working with China in areas where it is already, or may soon be, a leader.

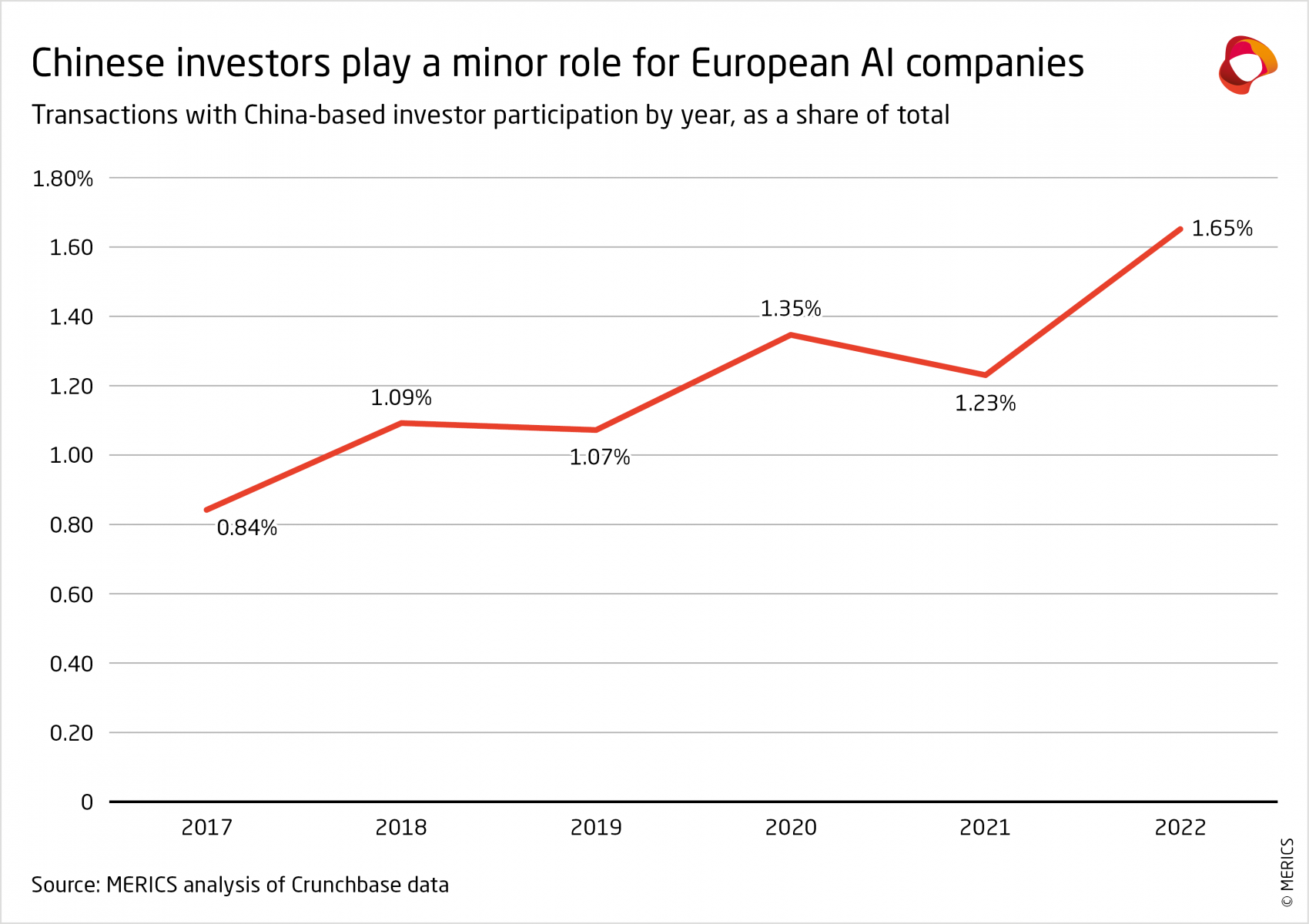

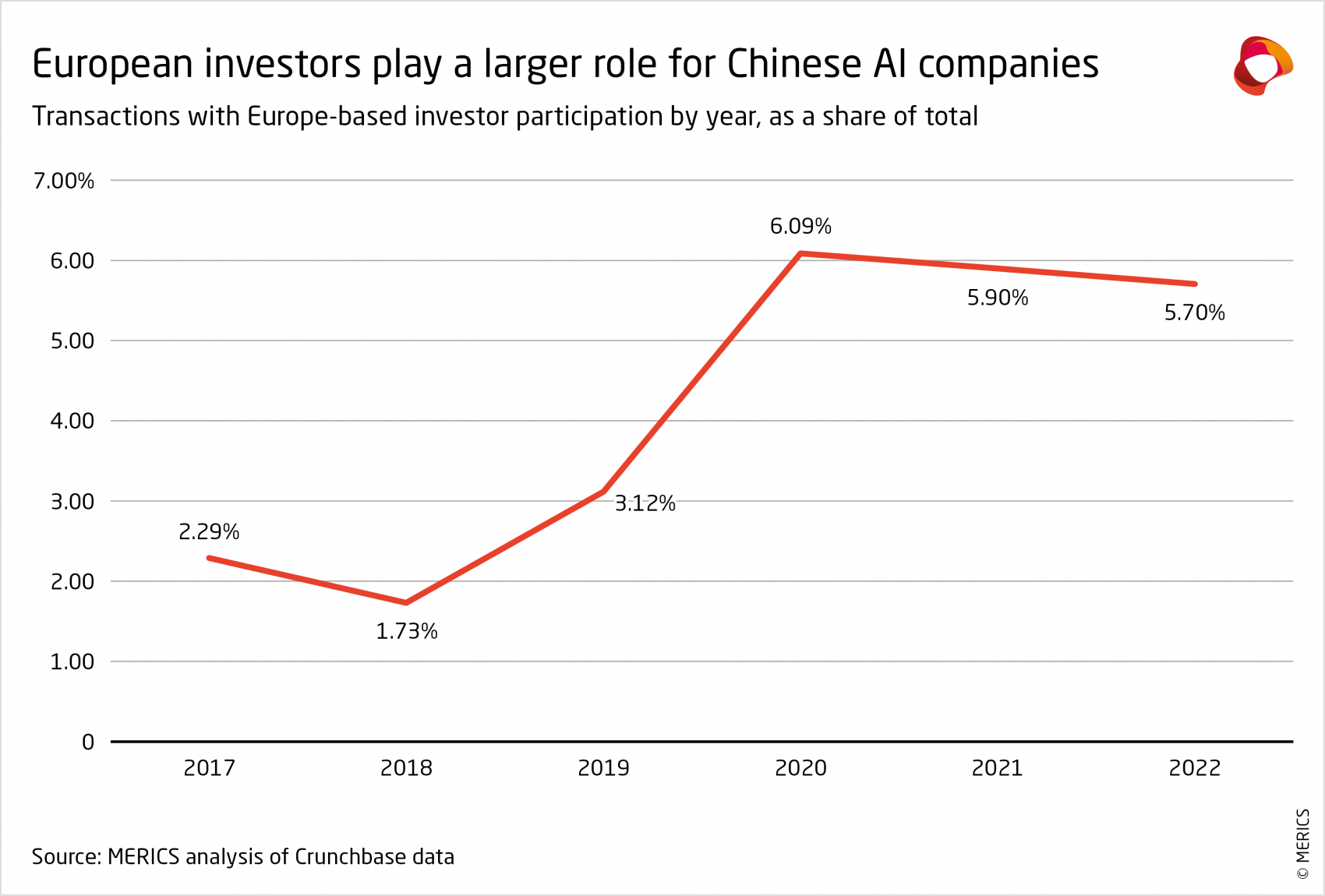

- Mutual investment in AI companies remains a small phenomenon. From 2017 to 2022, investors based in China and Hong Kong participated in at least 1.2 percent of investments in the European AI sector, whereas European investors contributed to 3.7 percent of investments in China.

- Investment relations are also a two-way street. Inbound investment can provide European AI startups with critical access to capital, whereas outbound investment can allow access to technology, expertise, and markets in China. But some transactions pose obvious national security or human rights risks.

- The challenge for Europe is to implement a more systematic, recalibrated approach to R&D and technology collaboration with China. A broad severing of AI ties is not realistic, therefore European governments have an important role to play in enabling and preserving safe, ethical, and beneficial collaboration.

1. Introduction: China and Europe are deeply entangled in AI

AI is a frontier and foundational technology field with enormous implications. It is hugely relevant for economies, societies, and governance, and it plays an increasingly pivotal role in addressing global challenges. China’s ambitions and growing capabilities in research and applications have made it a powerhouse of AI innovation at the center of global R&D networks, networks from which it has benefited tremendously.

AI’s military relevance, the intensifying rivalry between China and the United States and the Chinese Communist Party’s (CCP) use of AI to strengthen its authoritarian rule overshadow cooperation. US National Security Advisor Jake Sullivan called AI one of the “force multipliers” across the technology ecosystem, and Chinese Party and State Leader Xi Jinping dubbed it a “strategic handhold for China" in global science and tech competition”.1 Amid growing geopolitical competition, national security concerns, and ethical dilemmas, joint labs were shut down and people-to-people exchanges subjected to greater government scrutiny.2

Experts seem more concerned than policymakers about the side effects of this technological rivalry.3 There are concerns that the rapidly evolving deployment of ever more capable AI systems, like GPT-4, could pose serious social and even existential risks, unless similar effort is devoted to safety, alignment and other risk research.4 This requires different countries to work together.5 China’s participation in a major summit on AI safety hosted by the UK government in November 2023 was an encouraging sign.6

Europe benefits from global networks in AI, a field that has traditionally been deeply collaborative. AI innovation relies on open-source projects that bring together experts from multiple countries. Breakthroughs in software iterate fast and collaboration enables higher impact. Many stakeholders from different countries also collaborate based on their shared interest in ensuring that AI is developed safely, ethically, and responsibly, and in a manner that helps tackle pressing global issues.

At the same time, as an emerging technology with important dual uses, AI offers a case study of if and how Europe can preserve beneficial collaboration with a country that leads in innovation and is ruled by an authoritarian regime while managing the associated ethical, human rights and security risks.

The EU and China lead the world in AI governance. In June, the European Parliament endorsed the EU AI Act.7 China has made headways in algorithmic regulation and tackled specific applications such as deepfakes, autonomous vehicles, and generative AI.8 Political and values differences complicate intergovernmental engagement, therefore the EU prioritizes collaboration in AI regulation, standardization, and R&D with liberal democracies.9 Nonetheless, Chinese and European experts engage on critical ethics and governance questions. Meanwhile, how AI innovation ecosystems and research communities in Europe and China interact has received less attention.

Measured by the publication of AI research results, China and the United States are each other’s top partners. Between 2010 and 2021, according to one database, there were 64,325 such Chinese-US co-authored publications, nearly triple UK-US ones, the next-highest quantity.10 China-born researchers have played a crucial role in advancing US AI research.11 Although Washington imposed export restrictions on leading Chinese AI companies, limited exports of AI-relevant semiconductor technology to China and prepares to screen certain US outbound investments in Chinese AI firms, the two countries’ industrial ecosystems remain deeply enmeshed.12

But Europe’s world-class AI research and startups also make it an attractive partner for China. European and Chinese scientists regularly come together at conferences, co- author papers, and collaborate within university and corporate R&D labs. As noted, the United Kingdom is second only to the United States in the number of Chinese-coauthored publications. Next comes the EU collectively.13

European-Chinese ties in commercial AI innovation are also significant. Several European companies have AI labs in China, while Chinese firms offer products and services in Europe.14 Corporate R&D partnerships aim to use AI for a variety of applications, like drug discovery, and China is a market for some European AI products and services.15 Being in the country could allow European investors to tap new technology and knowledge as well as to access one of the world’s largest markets. Since research and applications are often closely intertwined, such access matters not only for commercialization but also for R&D advances.

The need to understand Europe’s entanglements with China is pressing given AI’s relevance for its societal wellbeing, economic competitiveness, and national security. Policymakers, industry, the research community and civil society worry about Europe becoming a second- tier player whose innovations and talent feed China and the United States.16 The EU and several member states have committed billions of euros in investment to catch up.

Europe’s underperformance in commercializing AI exacerbates concerns about China’s targeting of foreign civilian technology and knowledge to modernize its military.17 With an eye to China, the European Commission listed AI among the critical technology areas for which it recommends that member states jointly assess the risk of technology leakage – including to military end-users and human rights abusers – by year-end.18 The associated European Economic Security Strategy, published in June, also mentions the need to protect research security.19

Collaboration with China is challenging also because the CCP uses AI technologies to control ethnic minorities and society as a whole.20 AI’s role in human rights abuses in Xinjiang has led to increased scrutiny of R&D collaboration in the United States.21 In Denmark, a media investigation into research ties with Chinese partners, including with surveillance tech giant Hikvision on algorithmic public opinion monitoring, led to a multi-stakeholder effort to protect research security and integrity in international collaboration.22

Whether technology, knowledge and capital transfers from Europe are helping China outcompete advanced economies in AI R&D is the object of debate. As China becomes a top player in AI research, however, collaboration has become more of a two-way street. European countries have an interest in maintaining connections to be part of cutting-edge research efforts happening in China.

This report assesses the collaboration between China and the EU, Norway, Switzerland, and the United Kingdom along three axes: research co-authorship, investment, and research labs. It finds dense and diverse entanglements which often go back to initiatives of individual scientists, rather than institutional partnerships. Within the same AI subfields, research partnerships and investments that raise ethical or national security concerns coexist with benign outputs and applications. The same AI model can be used for good and bad purposes, making drawing red lines difficult.23

A recalibration of collaboration with China is needed, based on an informed assessment and management of risks, as opposed to a severing of ties that would compromise the benefits from exchange.

2. European-Chinese co-authorship in AI research

To remain competitive in AI innovation, foster the right kinds of collaboration, and assess risks, European policymakers need a better picture of existing research collaborations with China. AI is an especially potent field for collaborative work – it does not require physical proximity, and the pervasive culture of open-source research has allowed teams around the world to quickly build on each other’s work to achieve breakthroughs.25 Many advances in neural networks and machine learning can be credited to the global open- source movement. One trend is scientists uploading “pre-prints” of their academic articles in online repositories, like arXiv.26

The global AI R&D landscape has undergone profound shifts over the past 10 – 15 years. A study of the most-cited AI papers published between 2006 and 2016 found that the EU was declining in scientific excellence while China was rising.27 According to another study, China overtook the EU in 2016 in the top one percent most-cited AI research papers. As of 2019, China had a clear lead in computer vision research, was catching up with the United States and the EU in robotics, and no longer lagged the EU in natural language processing (NLP).28

2.1 Collaboration has grown but lags China’s AI output growth

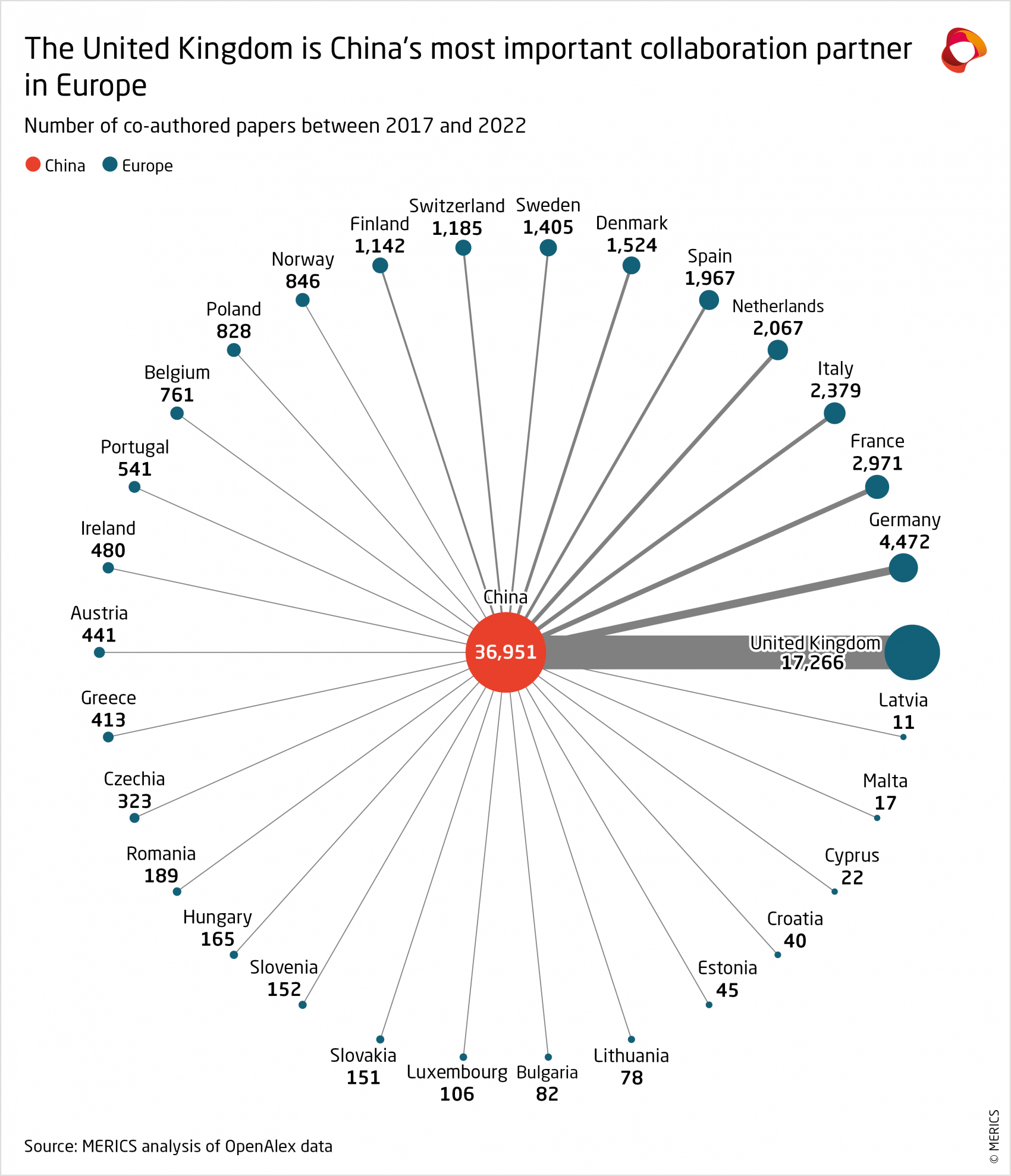

The research for this paper identified a dataset of 36,951 English-language, AI-relevant research papers published between 2017 and 2022 that were co-authored by at least one individual claiming affiliation with an institution based in China (mainland or Hong Kong) and one individual with an entity based in Europe. Of these papers, roughly 47 percent were the product of Chinese-UK collaborations, confirming previous findings regarding the extent of AI research ties between the two countries. Chinese-German collaborations were next at about 12 percent followed by Chinese ones with France, Italy, and Spain (see Exhibit 1).

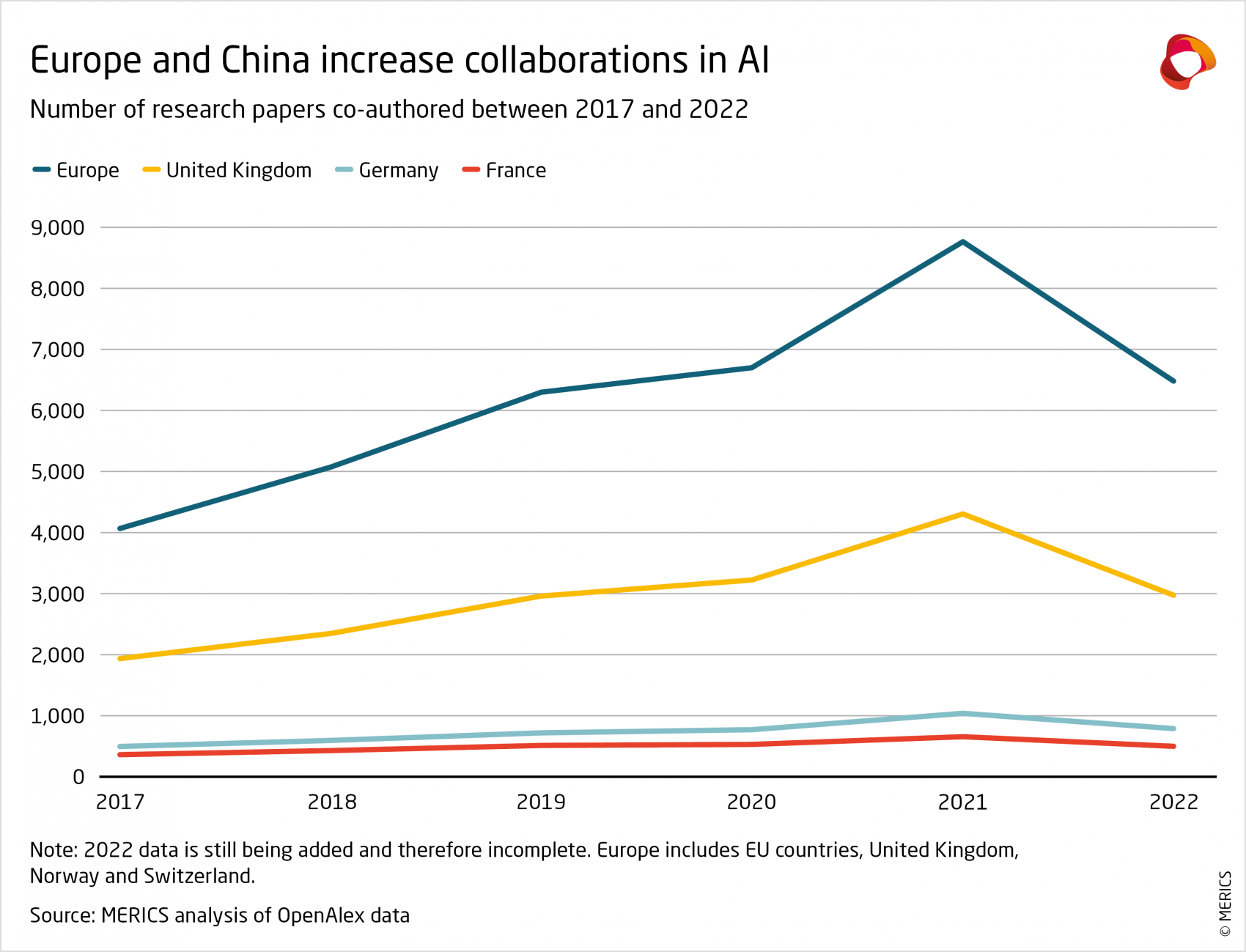

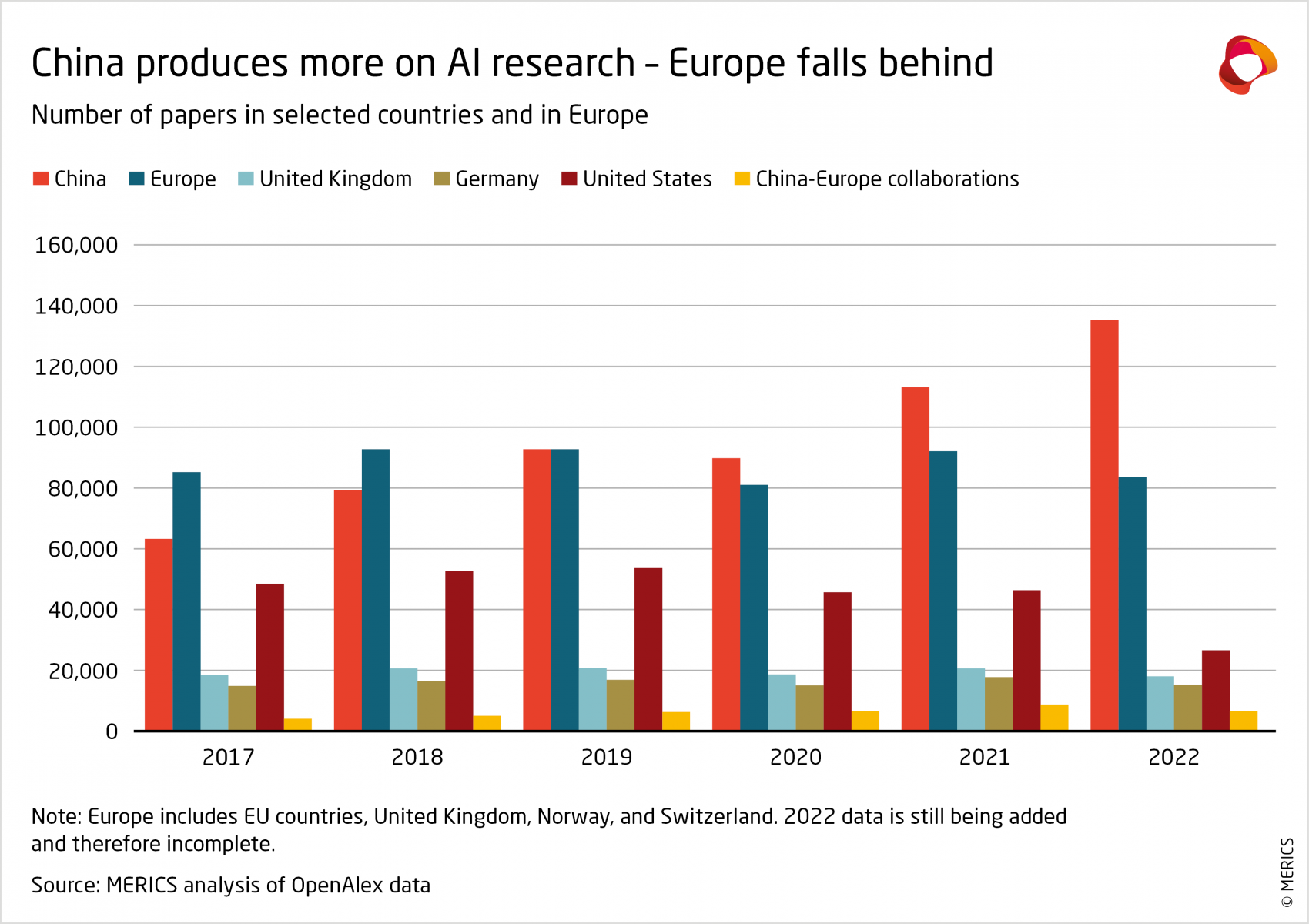

Overall, co-authorship increased steadily from 2017, with a steep rise in 2021, mirroring a general trend of higher AI research output in China and Europe. In 2021, there were more than twice as many co-authored papers as in 2017. Likely due to the Covid-19 pandemic, co-authorship increased more slowly in 2020, as did AI research outputs in general on both sides (see Exhibit 2).29

In terms of quantity of research papers published, China and European countries are becoming more important partners, albeit at a different speed. The share of co-authored AI papers grew from around 5 percent of Europe’s total in 2017 to around 10 percent in 2021, whereas it went from 6 to 8 percent of China’s total. The reason behind this flatter trendline is that China-authored papers are increasing at a higher rate than co-authored papers, while Europe’s output grew slower than both China-authored and co-authored papers.

Crucially, many China-authored papers – roughly 80 percent in 2020 – are published in Chinese-language journals only.30 Most of those do not involve any international partners and thus are not included in the dataset – had they been, the share of co-authored papers in China’s total output would have been much smaller.

The United Kingdom was involved in producing roughly one-sixth of Europe’s AI papers but almost half of European-Chinese co-authored papers. Between 2017 and 2021, the share of UK papers co-authored with Chinese partners rose from 11 to 21 percent. This probably reflects the United Kingdom’s close people-to-people ties with China and it being the top European destination for Chinese students. By contrast, co-authorship with UK partners accounted for an average three percent of China’s English-language AI research output over the same period. This indicates that authors with Chinese affiliations contribute more to the United Kingdom’s AI research output than the other way around. The imbalance may reveal an emerging dependency, suggesting that limiting collaboration and losing Chinese talent would come at a cost (see Exhibit 3).

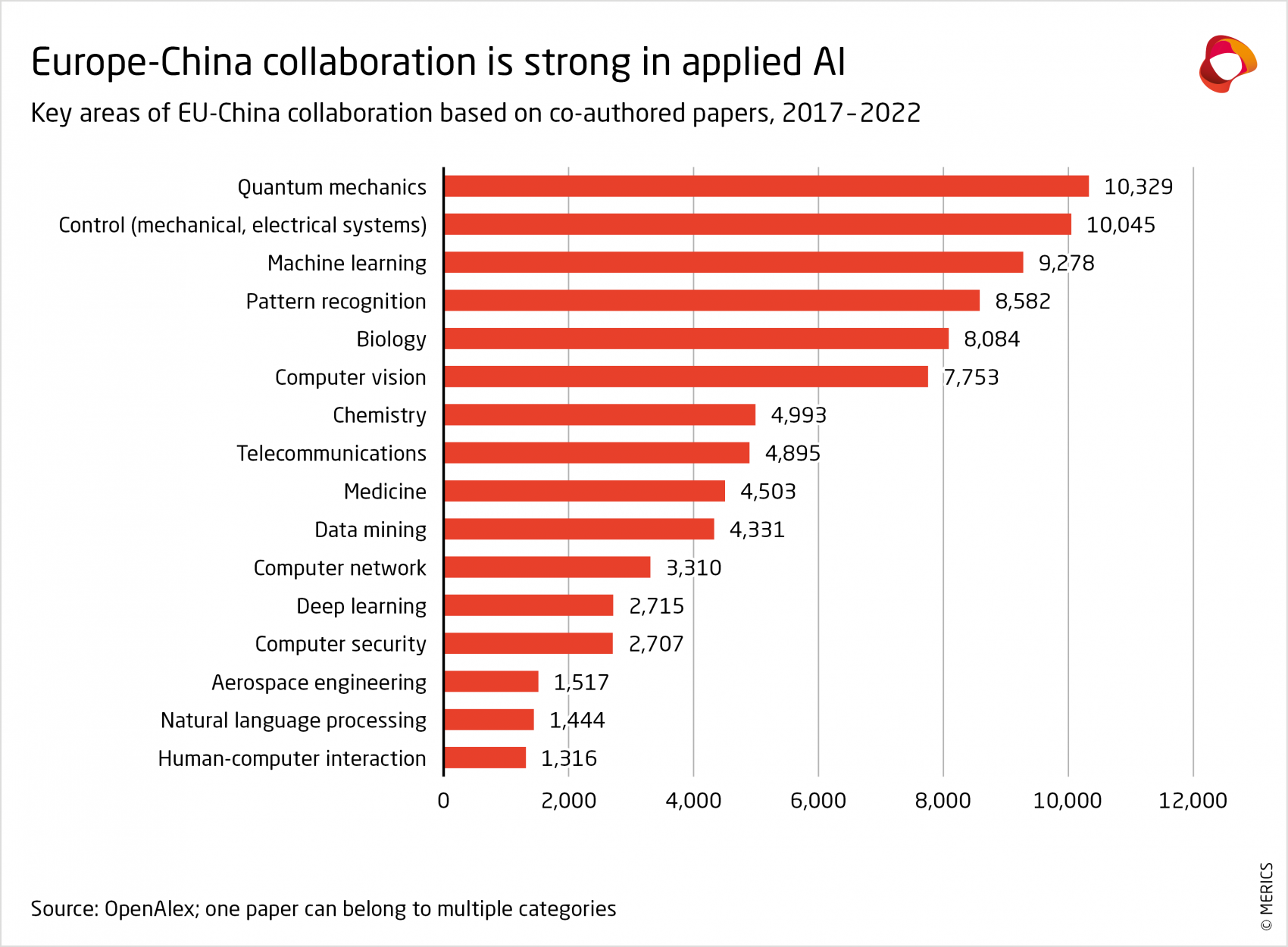

One AI-related subject in which European and Chinese authors frequently team up is computer vision, in which China is a leader. This could therefore be an example of collaboration benefiting Europe. Data mining and computer networks are other major areas of focus. By comparison, there was less co-authorship in robotics, where Europe is strong.31 However, given the important Chinese investments into European robotics startups, it is plausible that the sector is seen more as a commercial opportunity. This was confirmed by some interviewees (see Exhibit 4).32

2.2 Collaboration is driven by a small number of actors with outsized ties

Most Chinese and European institutions have very limited collaboration. According to one interviewee, research groups and individuals drive joint research, not institutional partnerships.33 Of the institutions analyzed for this study, 109 were involved in more than 1,000 co-authored papers in the dataset. Of these, 96 are Chinese. On the European side, nine are in the United Kingdom while only Denmark, Germany, and Switzerland also have institutions with such a large footprint – Aalborg University, Technical University Munich (TUM), and ETH Zurich (please see Exhibit 5).

Exhibit 5

The importance of long-standing ties between researchers is reflected in most co-authored papers not involving any formal institutional partnerships. British institutions with a Chinese campus or cooperation with a Chinese university have the largest number of co-authored papers of any single European actor in the network. But it is individual initiative that helps intensify such ties. The analysis also suggests many authors with a European affiliation can be assumed to be Chinese nationals studying or pursuing doctoral or postdoctoral research in Europe. This warrants more systematic research, but it is a reminder that knowledge is disseminated through complex networks of individuals moving across country borders for study or work.

In Germany, TU München has outsized importance in research networks with Chinese partners (see Exhibit 6). It is involved in seven of the top ten bilateral links between German and Chinese institutions. TUM has more than twice the number of Chinese-co-authored papers (1,348) than the university ranked second, RWTH Aachen. Of the 527 German institutions with co-authorship with Chinese ones, 370 have less than ten. There is a similar pattern in Switzerland with ETH Zurich dominating, followed by the École Polytechnique Fédérale de Lausanne. The United Kingdom does not have one such dominant institution, but nine institutions with more than 1,000 co-authorships, and another 25 with 500 or more.

Exhibit 6

Internationally co-authored AI papers have been cited more – an accepted measure of quality.34 English-language papers with only Chinese-affiliated authors have been cited less than those with authors affiliated with European countries like Germany, Switzerland, and the United Kingdom.35 At the same time, many papers with Chinese-affiliated authors only are among the most cited,36 reflecting the size and wide range of quality of China’s contributions to AI. Chinese-European papers have been cited more than European ones, suggesting that Chinese co-authorship improves the impact of European outputs.37

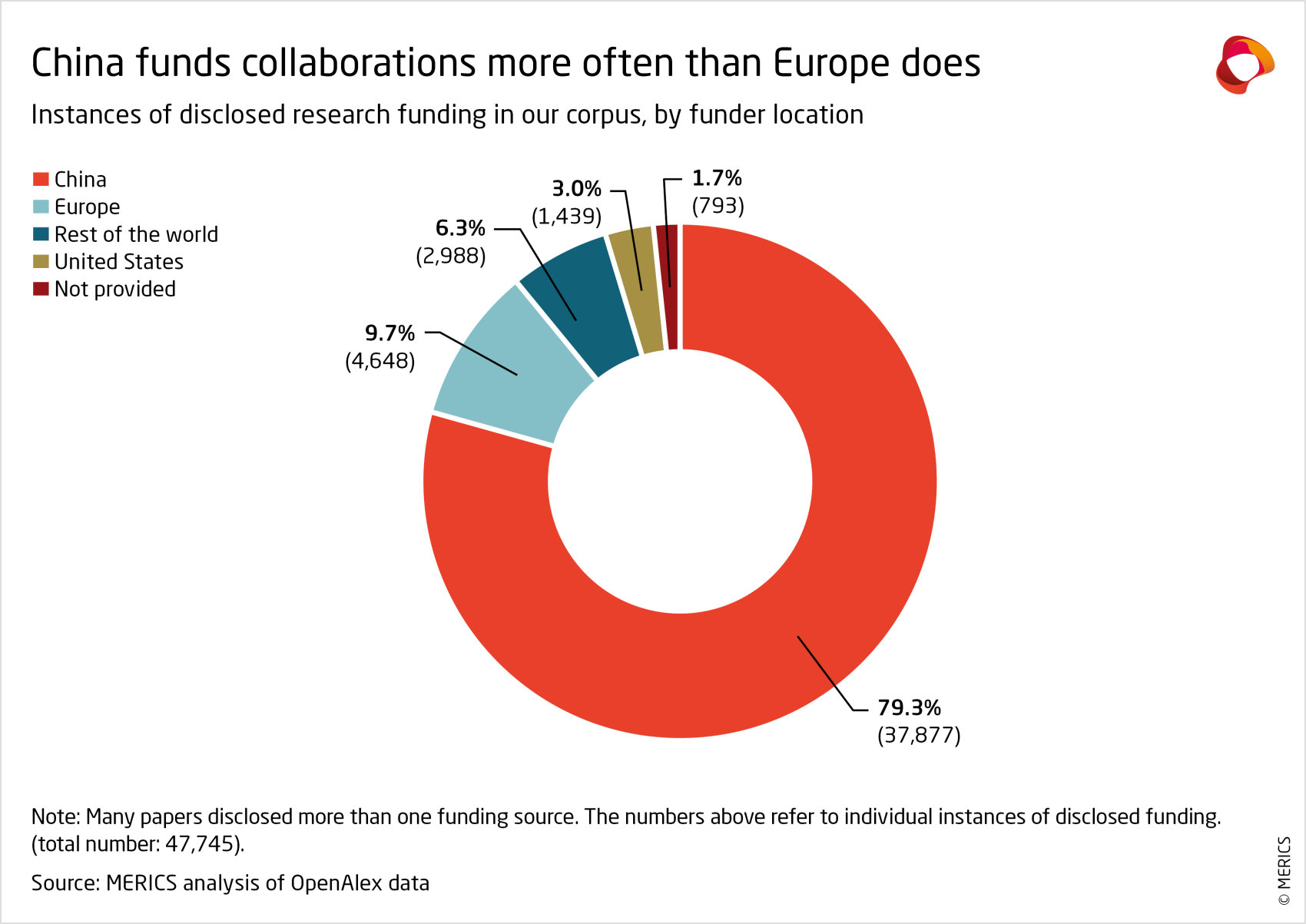

Among the papers whose funding source was disclosed (roughly half of the papers in our dataset), 80 percent were China-funded (see Exhibit 7). The overall disclosed funding came from Chinese government programs in 60 percent of cases, most of the rest from universities. For instance, the National Key R&D Programs (国家重点研发计划) initiative, an effort to align funding with national strategic priorities, was disclosed as a source for 1,823 papers.

How the funding is channeled highlights the strategic importance the government gives to AI, but also how it increasingly views it as a general-purpose technology. AI papers are funded in different workstreams outside of computer science. Some funding was more obviously oriented to strategic aims. For example, seven papers had funding from the National Defense Basic Scientific Research Program (国防基础科研计).

2.3 Research with potential dual-use, military, or surveillance applications

China seek to harness civilian AI innovation to strengthen the People’s Liberation Army (PLA) through the Military-Civil Fusion strategy (军民融合, MCF) and it views AI as a key military technology to defeat a superior and more experienced opponent.38 The PLA is primarily tasked with protecting the CCP and its hold on power, and China has geopolitical objectives that clash with European security interests.39 Collaboration that may aid the PLA’s modernization could put the security of Europe or that of its allies and partners in danger in the event of a conflict.40

The CCP also uses AI for intrusive surveillance, monitoring, and repression. Particularly troubling is its weaponization against social groups, like the Uyghurs and other ethnic Muslims, deemed threats to state security.41 Any redirection of research results from collaboration toward those purposes would be at odds with European values and potentially breach international human rights law. Unfortunately, some of China’s leading AI firms and even academic labs have developed symbiotic relationships with public security organs.42

This has lead policymakers in some democracies, especially in the United States, to restrict cross-border collaboration in a field once dominated by the norms of the global open-source movement.43 The fact that Chinese researchers can read and use published studies from other countries should temper expectations that blunt instruments such as export controls can stop the dissemination of knowledge.44 However, meaningful knowledge transfers may also occur during the research process itself.45

To minimize the risks in dealing with China’s system that increasingly blurs the lines between civilian, military and police institutions as well as between basic research and commercialization,46 European actors must know who their partners are and where they sit in the Chinese innovation system. Although it will be impossible to eliminate all risks, through attention to both partner institutions and application areas, it is possible to address the most problematic partnerships while letting the rest continue.

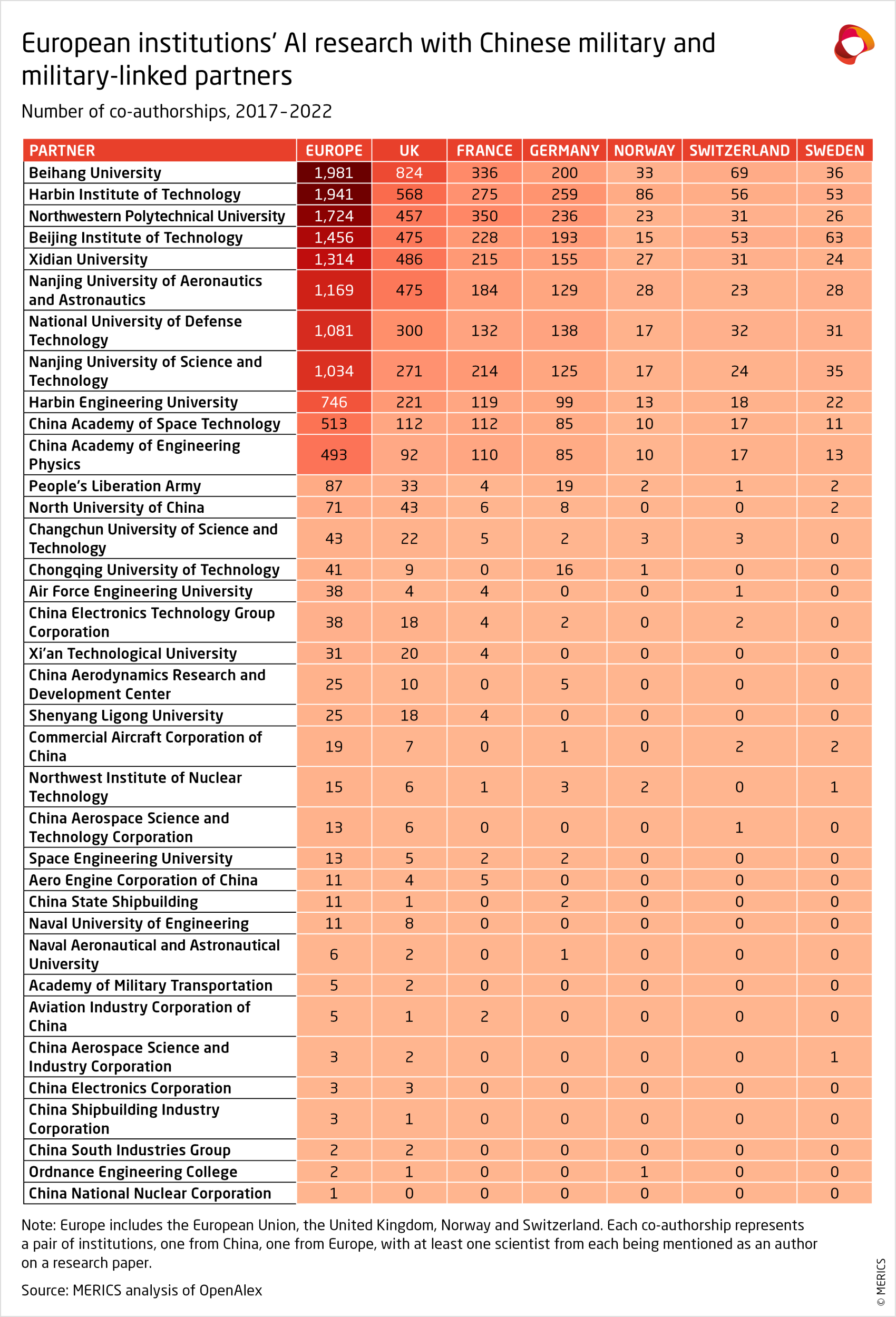

Our dataset includes 16,386 papers co-authored by European researchers with peers affiliated with Chinese entities either directly controlled by the military or having close ties to it—roughly half of all papers. Among these, we found significant ties with the so-called Seven Sons of National Defense, Xidian University (西安电子科技大学), and the National University of Defense Technology (NUDT, 中国人民解放军国防科技大学) which is the top research and education institution of the Chinese military (see Exhibit 8).

The Seven Sons are nominally civilian schools supervised by the Ministry of Industry and Information Technology, yet they constitute a major source of research and personnel for China’s military and defense-industrial base. Xidian’s computer science research supports several Chinese defense and intelligence projects.

Not all these links present the same national security or ethical risks – examining what research is being done with a partner is necessary. Therefore, this report identified papers including keywords associated with specific applications of AI – biometric surveillance, cybersecurity, information operations, and other military uses – and cross-referenced these papers with Chinese institutions presenting a heightened risk profile in these areas (see Annex). This showed that some of the collaborations involved were clearly problematic.

For example, in 2022, a researcher affiliated with the Bundeswehr University Munich, the prime research institute of the German military, co-authored a study with colleagues from the PLA Information Engineering University (中国人民解放军信息工程大学) that applies machine learning to extracting data from remote sensing images, which is one prerequisite for automated targeting systems. This university is subordinate to the Network Systems Department of the PLA Strategic Support Force(中国人民解放军战略支援部队), which oversees the Chinese military’s cyber, electronic, and psychological warfare capabilities.47

Identifying risky entanglements with nominally civilian universities and labs is less straightforward since many conduct significant amounts of defense- or security-relevant AI research. For example, there were numerous instances of European co-authorship with such universities on medical or environmental AI applications. This is also the case with other entities which we chose to exclude from our risk assessment: One of China’s leading institutions for AI research, Tsinghua University, carries out important military AI research and trains PLA students in computer science.48

Identifying what research is being done should not be an afterthought when assessing risks and designing due diligence and screening measures. In 2021, one researcher affiliated with the University of Huddersfield co-authored a study that proposed applying a double-flow convolutional neural network to better detect behavioral “abnormalities” through video surveillance with colleagues from the Xi’an University of Posts and Telecommunications (西安邮电大学). This university runs joint labs with China’s Ministry of Public Security (MPS), including one that develops AI applications for forensic purposes.49

To make informed decisions, AI researchers need to know their partners and be able to ensure that the research results will not be redirected to dangerous end-uses. Consider the cases of a European speech recognition researcher who was approached by iFLYTEK, a Chinese AI unicorn with a track record of developing repressive social monitoring tools for China’s police.50 In another case, a mathematician who develops algorithms that optimize target recognition was about to invite a Chinese researcher who works on killer drones.51 Neither collaboration materialized because the scientists listened to security advice.

3. Investment in AI companies: a two-way street

The Chinese and European AI ecosystems are also entangled through investment. Investment in startups is key for commercializing emerging technologies like AI. Inbound investment can provide European early-stage AI companies with critical access to capital, whereas outbound investment can help European investors in China to access technology and expertise, boost corporate influence, and secure their footprint in a key market.

However, European policymakers are increasingly concerned about the security implications of investment relations with China in strategic technologies. Most European countries analyzed in this report have an inbound investment-screening mechanism (Norway and the United Kingdom also have legislation to that effect; Switzerland does not) and the European Commission is considering an outbound investment-screening instrument. The rationale is that inbound investment potentially provides problematic Chinese investors with technology access and influence, while outbound investment risks capital, technology, and knowledge transfers to companies with ties to the likes of the PLA or the MPS.

An analysis of investment data provided by Crunchbase reveals that AI investment in both directions has considerably increased since 2017, peaking in 2021, but is still relatively low. There were more Chinese investments in Europe than vice versa (98 and 81 transactions, respectively).52

Chinese investors put smaller amounts in various early-stage startups while European investors joined larger transactions in later-stage funding rounds. The estimated capital raised by China’s AI sector from transactions involving European investors was EUR 11.2 billion, whereas the amount in the other direction was EUR 1.4 billion.

Two caveats are necessary. First, since most funding rounds involved more than one investor, with individual shares not disclosed, we do not know how much of that capital came from Chinese and European investors. Second, determining the original source of an investment is extremely complex, particularly when it comes to Chinese investment vehicles where party-state control is obfuscated.53 Our analysis is based on registered headquarters of investing entities. Because Chinese-controlled funds are sometimes headquartered outside China, it is likely that Chinese investments into European firms are undercounted significantly. Some European investments too may have been made via third countries.

3.1 Chinese investment in European AI companies

Between 2017 and 2022, 3,765 AI companies in European countries secured funding through 8,037 transactions. Of these transactions, 98 included China-based investors (see Exhibit 9): 1.2 percent of the total. These transactions brought an estimated EUR 1.4 billion to 76 European AI companies. Their number rose from nine in 2017 to 22 in 2022, with a peak in value of EUR 685 million in 2021. The investors were particularly active in seed funding rounds (38 percent of transactions) while most capital went into five series C transactions (29 percent). (Series A, B, and C are financing rounds that generally follow seed funding and angel investing, providing investors with the opportunity of injecting cash in a growing company in exchange for equity or partial ownership.) Of the 98 transactions, 43 involved companies in the United Kingdom and 20 companies in Germany.

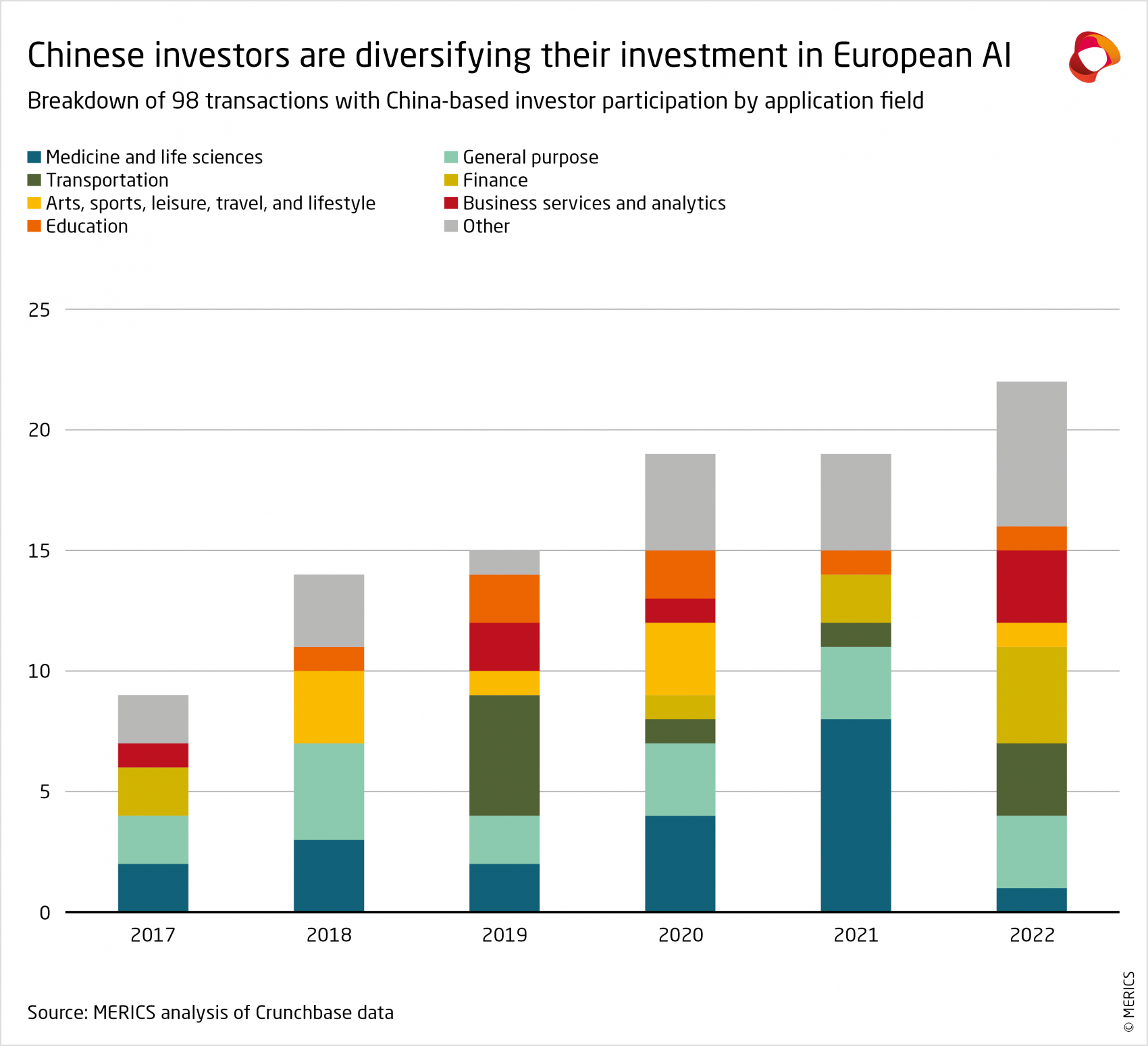

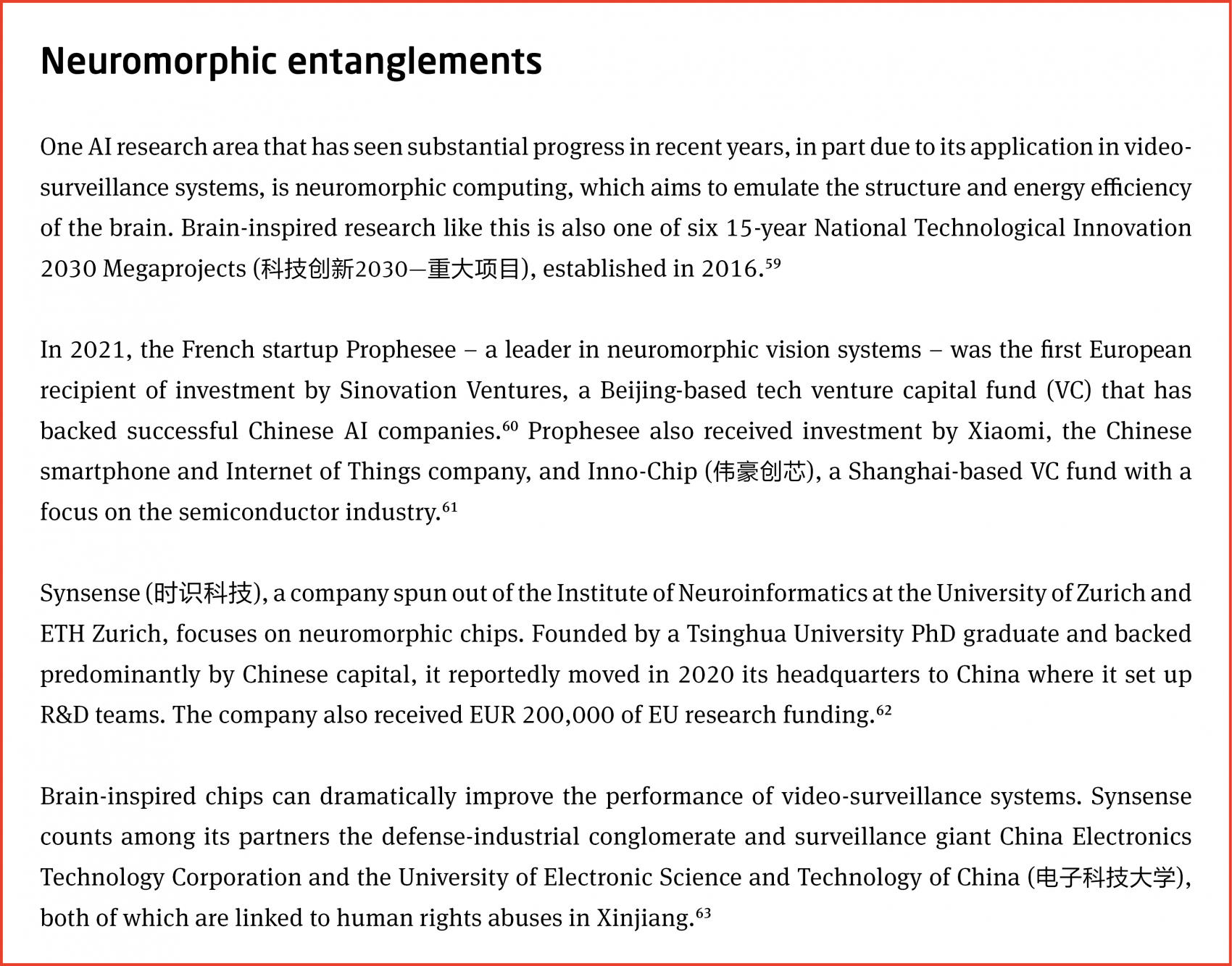

A diverse set of AI subfields received funding from Chinese investors. Medicine/life-science and general-purpose AI were the targets of 20 and 17 transactions, respectively (see Exhibit 10). These sectors secured over EUR 500 million in 2021—more than a third of the estimated volume over the period. This seems consistent with the prominence of these fields in European-Chinese AI-related publications as well as with policies in China that encourage applying AI to solve challenges like population aging and diseases. In 2022, the number of transactions peaked, and investments diversified from these two subfields to over a dozen different sectors.

The two largest investments were in Exscientia and Agile Robots. Exscientia, an Oxford- based AI drug discovery company, completed a EUR 206 million series D funding round to which two China-based investors contributed an undisclosed sum.54 Agile Robots, a Munich-based, German-Chinese spin-off of the German Aerospace Center, raised EUR 201 million. It focuses on industrial robots using AI-driven software.55 One of its co-founders studied at the Harbin Institute of Technology and has close ties to China.56

Chinese AI investment in Europe does not necessarily translate into undesirable party- state influence or technology transfer, and further research should investigate the role of state-owned investors. In fact, Chinese investment may bring opportunities: For example, in 2023, Lenovo was the only investor in the series A funding of Nyonic, a new German startup committed to creating European foundational models.57 Given the importance of this startup’s mission, remaining independent will be key.58

Since not all European countries have investment screening legislation in place, and not all who do screen transactions below 10 percent of a company’s shares, investments that may pose risks to national or economic security could evade scrutiny. The matter becomes more complicated when Chinese investors fund university spin-offs in Europe and then transfer the company to China.

3.2 European investment in Chinese AI companies

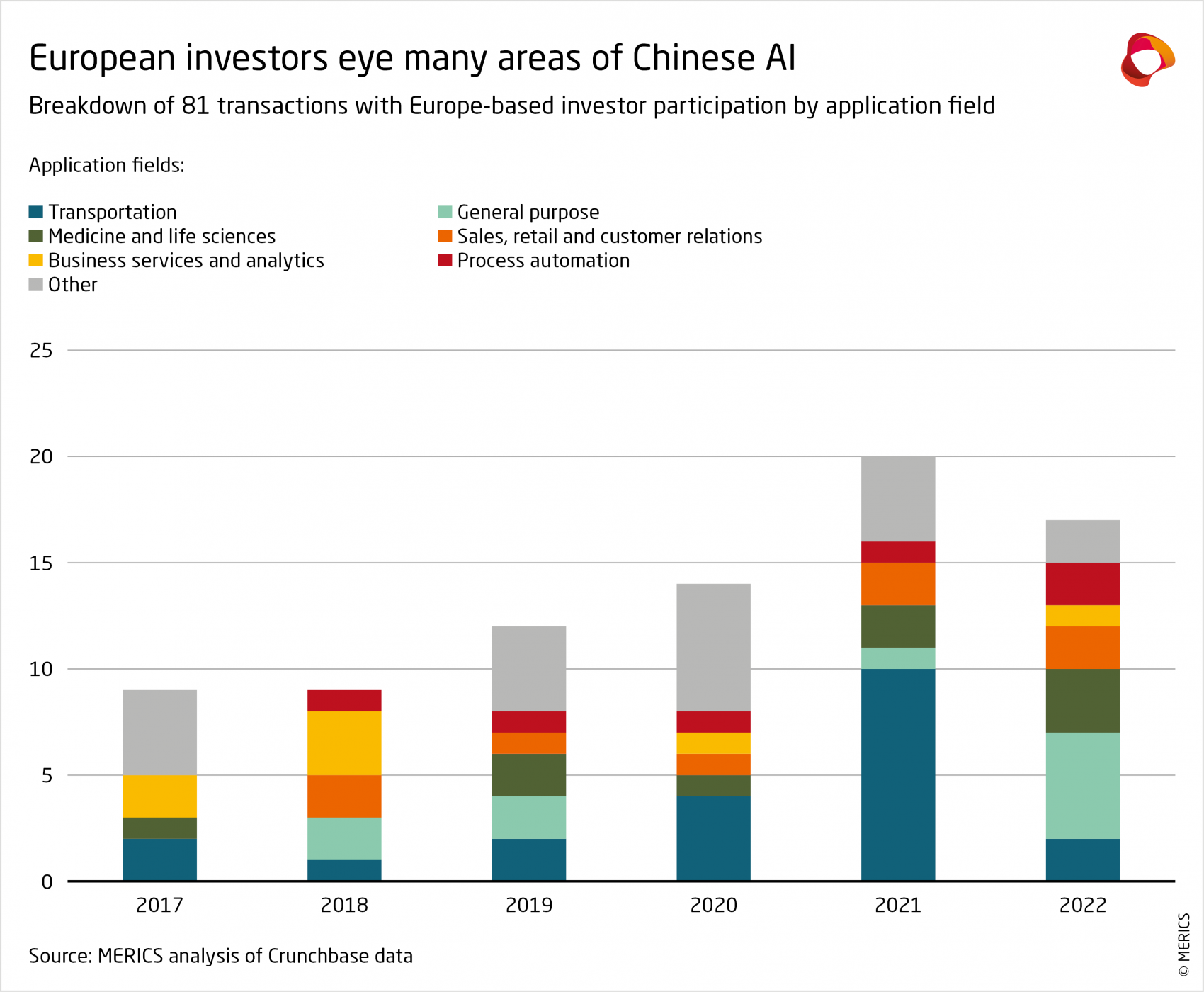

European investors played a slightly more prominent role for AI companies in China than vice versa. Between 2017 and 2022, 1,194 AI companies secured funding in 2,165 transactions, of which 81 (3.7 percent) had Europe-based investor participation (see Exhibit 11). For comparison, one study found that US investors were involved in 17 percent of transactions in the Chinese AI sector between 2015 and 2021.64

The 81 transactions brought funding to 64 Chinese companies. They were concentrated in larger funding rounds and totaled an estimated EUR 11.16 billion, almost eight times the amount raised by European companies from transactions involving Chinese investors.

European investors participated in fewer transactions than Chinese investors, but those transactions raised higher sums and were concentrated in later funding rounds, with more than two-thirds of the total funding going into series C (25 percent), D (25 percent), and E (18 percent) rounds. Later-round investments are typically associated with much higher valuations because a company’s product is closer to commercial viability.

European investors are still tapping into the opportunities arising from China’s smart mobility market. In 2021, half of European investments were in AI companies in the transportation sector, including autonomous driving and warehouse and logistics systems However, European investments in Chinese AI became more diverse in 2022. (see Exhibit 12).

The value of some investments in Chinese AI companies with European participation almost matched the cumulative value of transactions that involved Chinese investors in the other direction over the period (EUR 1.4 billion). For example, the ride-hailing company Didi Chuxing Technology secured a debt financing round in 2021 that raised more than EUR 1.4 billion, including from HSBC and Barclays.65

European investment into Chinese AI firms may elicit concerns, considering Beijing’s civil- military fusion strategy and human rights violations. UK-based Aurora Private Equity was one of two leading investors in the series B round that raised EUR 12.8 million for Marknum Technology (吗牛科技).66 Marknum is a cybersecurity-focused AI and Big Data analytics firm whose main business entails providing solutions to Public Security Bureaus (including in Xinjiang) from monitoring online behavior to data-driven social control.67

While the analysis revealed only a handful of problematic cases involving firms linked to the military or police, these demonstrate that European investment in China’s AI sector warrants more systematic scrutiny. Since our results are limited to private companies, we did not capture transactions in publicly listed Chinese firms whose role in the CCP’s AI surveillance programs should raise serious concerns.68 That said, European investors’ role is small overall, and policymakers must weigh the risks against the possible benefits in terms of market access or inbound tech and knowledge transfer from China.

4. Inside the labs: How European and Chinese scientists and technologists work together

Formal partnerships between Chinese and European academic research institutes have sometimes led to technology and knowledge transfers in both directions impossible for analysts and policymakers to quantify. The activities of corporate AI lab are similarly complex and multifaceted (see Annex).

With the CCP seeking to make China “the world’s primary AI innovation center”74 by 2030 and to harness AI for military modernization and social control, labs are facing new economic, political, geopolitical, and ethical dilemmas. The confluence of these factors has led US companies like Google and IBM to shut down their AI labs in China.75 In Europe’s case, labs established by research institutes to facilitate knowledge transfer to China are becoming less relevant. However, European companies that want to tap China’s market, talent and expertise continue to set up labs deeply embedded into local research networks.

4.1 LIAMA: European expertise helped establish Chinese computer science

The Sino-European Laboratory of Informatics, Automation and Applied Mathematics (LIAMA, 中欧信息自动化应用数学联合实验室) was set up 1997 to help China develop its AI research, “stimulating Chinese colleagues to publish in international venues”.76 This may have made sense at the time, but a different cost-benefit analysis applies today. LIAMA was founded by the Institute of Automation of the Chinese Academy of Sciences (CASIA, 中国科学院自动化研究所) and the French National Institute for Research in Digital Science and Technology (INRIA).77

At its peak LIAMA connected 18 labs in China and France to train scientists and implement joint projects. Other Chinese and European actors, such as Airbus, Centrum Wiskunde & Informatica, Northwestern Polytechnical University (西北工业大学), and Tsinghua University (清华大学) joined later, with the partnership renewed several times.78 Research results spun modeling and simulation in the environmental and life sciences, remote sensing, multimodal perception and scene understanding, cryptographic algorithm security, human-machine interaction, AI-brain research, and neuromorphic chips. CASIA credits its Brainnetome Project79 – a brain atlas that represents one of China’s most advanced efforts at the intersection of AI and neurosciences – to LIAMA.

Although Inria and CAS maintain a co-funding agreement, LIAMA’s website was down at the time of writing and its last reported activities took place in 2019.80 With CASIA now a globally renowned institution for advanced AI research and home to breakthroughs in areas like brain-inspired intelligence, a rethink is likely underway.

Indeed, it is difficult to imagine how collaborative projects on biometric recognition with CASIA,81 particularly with its National Laboratory of Pattern Recognition (模式识别国家重点实验室) that was LIAMA’s hosting institution on the Chinese side, would receive official blessing today. CASIA has extensive partnerships with China’s public security organs, which in some cases have led to the commercialization of mass surveillance technologies such as video surveillance and iris, facial, and palmprint recognition, including by the MPS in Xinjiang.82

4.2 In China, for China: Siemens’ AI Lab in Beijing

The private sector is a major force in global AI R&D networks. Firms publish papers, file patents, and conduct basic, experimental, and applied R&D that advances the field and brings products and services to customers. In the dataset of papers analyzed, 8,457 (roughly 20 percent) have co-authors claiming affiliation with a company in China or in European countries. Of these, 3,751 have a Chinese corporate lab-affiliated co-author. Previous research on US multinationals’ global AI labs showed that access to talent is the top reason for firms to conduct R&D abroad, though considerations of cost, market access, and proximity to customers also play an important role.83

The case of Siemens illustrates how European firms are setting up research facilities in China to benefit from its innovation ecosystem and talent pool. It also shows that they are navigating the more challenging geopolitical environment. In 2019, Siemens chose Beijing as the location of its first AI lab outside Germany.84 Its R&D in China has a strong applied focus, primarily in industrial AI, automation, and machine perception. Siemens made this investment based on the country’s competitive and AI-savvy industries, the availability of AI talent, and an institutional environment that enables fast experimentation.85

The ongoing decoupling between China and the United States in certain sectors is making the situation more complex for Siemens. The company faces an added compliance burden in terms of due diligence of research partners and difficulties in procuring high-performance training chips due to US export controls.86 At the same time, being engaged in government- university-industry partnerships in China could also enable Siemens to influence things to come. For instance, the company performs research on ethical, safe, and responsible AI together with Chinese partners.87 Such opportunities would be lost if Siemens shut down its lab.

4.3 Huawei in Europe: Seeking breakthroughs and poaching talent

The case of Huawei shows that Chinese corporate investments in Europe’s AI research ecosystem should be transparent so that the desirability of joint labs and projects can be debated – especially with a view to ensuring that Europe does not lose critical talent or know-how. Collaborations with Huawei that are explicitly oriented toward surveillance or defense applications are not in Europe’s interest.

Huawei chose Europe as one of its two main AI R&D hubs outside China, alongside Canada. In 2019, it announced an investment of EUR 100 million over the following five years to develop its AI Ecosystem Program in Europe.88 The company is tapping AI talent and expertise in the EU, Switzerland, and the United Kingdom, with prominent European scientists working for its labs.89

Between 2017 and 2022, researchers affiliated with Huawei co-authored 534 papers with European partners. Topics ranged from algorithm development to the acceleration of Recurrent Neural Networks (RNN) inference for 5G mobile communications using the open- source RISC-V architecture. Several papers had co-authors affiliated with Chinese defense universities. Some of the research outputs have obvious applicability in mass surveillance, like facial recognition. Huawei’s involvement with repressive surveillance projects in China is known.90

Its European labs focus heavily on fundamental AI research. The Future Computing Laboratory in Zurich explores innovations in computing systems and storage, including hardware, software, and algorithms.91 HiSilicon, Huawei’s chip-design arm, has been striving to develop chips for smartphone and telecommunications systems since US sanctions deprived it of access to core technology.92 Paris and London are among the locations of Noah’s Ark Lab, Huawei’s prime AI research lab. It focuses on computer vision, speech and language processing, AI theory, decision making and reasoning, search and recommendation, and human-computer interaction.93 Its Dublin lab is an exception, focusing on applying computer vision to biometric surveillance.94

Considering Huawei’s documented links to the China’s party state and its military and security apparatus,95 its access to cutting-edge European AI talent and knowledge raises ethical as well as national and economic security questions. In the Netherlands, Huawei providing EUR 3.5 million to a university lab focused on applying knowledge representation and reasoning to multilingual online search engines sparked a nationwide debate.96 This has increased the sense of urgency among lawmakers, government agencies and universities that measures to increase knowledge security and to mitigate risks need to be taken.97

5. Conclusion: rethinking research and tech security in the AI age

AI research collaboration is valuable for China and for Europe. China’s growing importance in the field make it a critical partner. Ultimately, European governments will have to accept the fact that it will not be possible to prevent any leakage or “spin-on” from commercial to military or surveillance AI, because that would mean halting collaboration across the board.98 And even then, the results of most European research would be published and accessible.

In the United States, the drawbacks and limitations of decoupling are already showing,99 and some argue that the country will become less competitive if it stops working with China.100 For Europe, severing ties would come at grave costs. Scientists work with Chinese colleagues to, for example, speed up drug discovery, predict or detect early signs of cancer, and save energy in 5G networks. Cutting China off in AI research would mean sacrificing opportunities to jointly tackle global challenges and to ensure the safe development and deployment of AI. It might also encourage the Chinese AI ecosystem to become more closed-off.101

It is difficult to make blanket judgments about AI as it is a general-purpose technology that is increasingly interwoven across many fields, from healthcare to predictive maintenance for manufacturing equipment. For example, the same computer vision techniques can help diagnose cancerous cells faster and identify the facial features of specific ethnic groups.102 Traditional distinctions between commercial and security-relevant or even between basic and applied research do not fit current realities.

Existing export-control regimes lack teeth when it comes to tackling the national security and ethical risks of AI entanglements with China. Some have argued about the limited utility of export controls for AI technology beyond computing power.103 This is reflected in the agreement between Japan, the Netherlands, and the United States to restrict exports of advanced semiconductor manufacturing equipment to China:104 Chips and machinery are dual-use items whose trade can be limited – but knowledge cannot be.105 In fact, EU export controls on AI-relevant technologies mostly focus on hardware. Member states could introduce controls for additional dual-use items, for example certain application-specific AI software, but this would require political will.

Basic research is exempt from EU export controls. However, one export controls compliance officer said that scientists at their university routinely conduct “clearly dual-use” AI research with military- and security-linked partners in China, most of which is not basic. A national export control authority recently ordered the interviewee to stop a project with one Chinese defense university because it involved unlisted AI software with potential military application.106

How, then, can Europe and Germany preserve beneficial collaboration with China while managing ethical and security risks? There should be a recalibration of R&D ties with Chinese scientists and institutions based on a more nuanced and informed assessment of risks, consistent with the messages put forth in the German government’s Future Strategy for Research and Innovation as well as in its China Strategy.107 One European firm we spoke to, for example, no longer partners with Chinese universities that are on the US Department of Commerce’s Entity List.108

While a government-imposed cutoff seems necessary in those cases where the risks are prohibitive, robust risk-management structures and practices would be more appropriate in other ones. Where European companies run labs in China in partnership with entities that have AI research lines focused on defense or surveillance uses, they should have rigorous security measures in place. At a minimum, they should vet staff and students to minimize the risk of knowledge leaking to the PLA or the public security apparatus.

Beyond institutional partnerships and joint labs, AI development is driven by complex networks of researchers, investors, companies, and research institutions. Governments should provide universities and researchers with the information they need to make good decisions, in what one interviewee called a “culture of responsibility”.109 The European Commission recommends researchers be cautious under circumstances where “the partner/ end-user is tied to the military, the defense industry or a governmental research body in a country with an arms embargo”.110 The EU maintains a non-binding embargo against China.

There should be dedicated and well-funded multistakeholder partnerships between policymakers, technologists, China experts, industry, academia, and civil society to raise awareness and share information.111 This should be complemented by policy and regulatory instruments that promote transparency and accountability, as well as appropriate updates to EU export controls.

Introducing measures apparently targeting a specific country – even in the form of information and resources to support due diligence of high-risk entities – would require a mindset shift in many European countries. Governments should consider declining clearances to work on certain AI-related subjects for students affiliated with universities directly controlled by or linked to the PLA, the MPS, or the Ministry of State Security.

Investment into China’s AI sector warrants more attention and monitoring, assuming that the objective of the EU outbound investment-screening instrument will be to prevent capital, technology, or knowledge flows to China’s military-industrial complex or surveillance state. Investment relationships, particularly early-stage venture capital investment, can bring expertise and other intangibles to the target companies in China.112

That said, Europe’s entanglements with China’s AI industry are negligible compared to those of the United States. There is no European equivalent to Microsoft Research Asia – instead, there are many research labs and startups that need guidance and support.

European-Chinese collaboration in AI takes place against the backdrop of geopolitical competition, a global race for talent, and the gradual erosion of research ties between China and the United States. As the latter is increasingly shutting out Chinese scientists,113 Europe could become a more attractive destination. Structuring cooperation networks in Europe’s favor will be key, be it in terms of prioritization of subfields, talent retention, commercialization of R&D results, or of protecting Europe’s research and startup ecosystem where necessary.

How should EU member states navigate collaboration with China in AI research and commercialization? A few options for action:

- Assess EU and Chinese strengths and weaknesses in this key area. Starting from the European Commission’s recent definition of critical technologies, member states should jointly map related value chains, ecosystems, and R&D networks, also to set priorities for cooperation with China.

- Invest in EU capabilities. China and the United States are investing heavily in AI and other foundational technologies. Besides EU research funding, labs and startups need better access to funding to be able to generate new ideas and bring them to market. Another priority should be to train and retain more AI talent, including from China.114

- Establish a multi-stakeholder body to advise researchers; for example, in the due diligence of Chinese AI labs. Some German universities have teams of lawyers and experts who advise on collaborations with Chinese partners, while the UK and Dutch governments set up advisory structures. Synergies between these and China experts should be strengthened.

- Consider proportionate personnel screening frameworks. Some European countries already have these in place for sensitive research fields, while the Netherlands is about to introduce one. Any such measures would have to be narrowly targeted to avoid discrimination based on nationality or blanket bans on institutions that conduct significant civilian research alongside defense one.

- Consider updating existing export controls. China and the United States have elevated emerging technologies to a battleground of strategic competition. Their export controls can impact EU actors. Multi-stakeholder consultations could help governments evaluate the usefulness and feasibility of new controls; for example, for some application-specific AI software and trained models.

- Launch a scoping exercise for an outbound investment-screening instrument. This could focus on gathering data about certain transactions by European companies in sensitive sectors in China, like AI. The risks, however, should be carefully examined in connection with potential gains from inbound technology transfer, innovation, or market access.

- Endnotes

-

1 | The White House (2022). “Remarks by National Security Advisor Jake Sullivan at the Special Competitive Studies Project Global Emerging Technologies Summit.” September 16. https://www. whitehouse.gov/briefing-room/speeches-remarks/2022/09/16/remarks-by-national-security-advisor- jake-sullivan-at-the-special-competitive-studies-project-global-emerging-technologies-summit/. Accessed: August 28, 2023; Kania, Elsa and Creemers, Rogier. New America (2018). “Xi Jinping Calls for ‘Healthy Development’ of AI (Translation).” November 5. https://www.newamerica.org/ cybersecurity-initiative/digichina/blog/xi-jinping-calls-for-healthy-development-of-ai-translation/. Accessed: August 28, 2023.

2 | Sheehan, Matt, Kerry, Cameron F., and Meltzer, Joshua P. Brookings (2023). “Can Democracies Cooperate with China on AI Research?” January 9. https://carnegieendowment.org/ publications/88777. Accessed: May 15, 2023; Knight, Will. Wired (2020). “MIT Cuts Ties With a Chinese AI Firm Amid Human Rights Concerns.” April 21. https://www.wired.com/story/mit-cuts- ties-chinese-ai-firm-human-rights/. Accessed: August 28, 2023; Kaye, Kate. Protocol (2022). “US policymakers could be alienating the Chinese AI researchers they want to attract.” November 2. https://www.protocol.com/enterprise/us-china-ai-researchers-talent. Accessed: June 10, 2023.

3 | Kaur, Dashveenjit. Tech Wire Asia (2023). “OpenAI reaches out to China for AI safety guidelines.” June 12. https://techwireasia.com/2023/06/openai-reaches-out-to-china-for-ai-safety-guidelines/. Accessed: August 28, 2023; Fedasiuk, Ryan. Foreign Policy (2022). “The U.S. and China Need Ground Rules for AI Dangers.” https://foreignpolicy.com/2022/04/27/us-china-artificial-intelligence- dangers/. Accessed: August 28, 2023.

4 | Variations of these concerns have been articulated by reputable experts from various fields, within both industry and academia, before and after the release of Chat-GPT. See: Future of Life Institute (2023). “Pause Giant AI Experiments: An Open Letter.” March 22. https://futureoflife.org/open- letter/pause-giant-ai-experiments/. Accessed: August 28, 2023; Bender, Emily M., Gebru, Timnit, McMillan-Major, Angelina et al. (2021). “On the Dangers of Stochastic Parrots: Can Language Models Be Too Big?” FAccT '21: Proceedings of the 2021 ACM Conference on Fairness, Accountability, and Transparency: 610-623; Hendrycks, Dan and Mazeika, Mantas. ArXiv (2022). “X-Risk Analysis for AI Research.” September 20. https://arxiv.org/pdf/2206.05862. Accessed: August 28, 2023; Leverhulme Centre for the Future of Intelligence. “Safety, Security and Risk.” http://lcfi.ac.uk/projects/ai-futures- and-responsibility/safety-security-and-risk/. Accessed: August 28, 2023.

5 | Kerry, Cameron F., Meltzer, Joshua P., Renda, Andrea et al. Brookings (2021). “Strengthening international cooperation on AI.” October 25. https://www.brookings.edu/articles/strengthening- international-cooperation-on-ai/. Accessed: August 28, 2023.

6 | UK government (2023). "The Bletchley Declaration by Countries Attending the AI Safety Summit, 1-2 November 2023." November 1. https://www.gov.uk/government/publications/ai-safety-summit-2023- the-bletchley-declaration/the-bletchley-declaration-by-countries-attending-the-ai-safety-summit-1-2- november-2023. Accessed: November 9, 2023.

7 | European Parliament (2023). “EU AI Act: first regulation on artificial intelligence.” June 14. https://www.europarl.europa.eu/news/en/headlines/society/20230601STO93804/eu-ai-act-first-regulation- on-artificial-intelligence. Accessed: August 28, 2023.

8 | Sheehan, Matt. Carnegie Endowment for International Peace (2023). “China’s AI Regulations and How They Get Made.” July 10. https://carnegieendowment.org/2023/07/10/china-s-ai-regulations-and- how-they-get-made-pub-90117. Accessed: August 28, 2023; Arcesati, Rebecca and Brussee, Vincent. The Diplomat. (2023). “China’s Censors Back Down on Generative AI.” August 7. https://thediplomat. com/2023/08/chinas-censors-back-down-on-generative-ai/. Accessed: August 28, 2023.

9 | The White House (2023). “U.S.-EU Joint Statement of the Trade and Technology Council.” May 31. https://www.whitehouse.gov/briefing-room/statements-releases/2023/05/31/u-s-eu-joint-statement- of-the-trade-and-technology-council-2/. Accessed: August 28, 2023.

10 | Center for Security and Emerging Technology. Emerging Technology Observatory’s Country Activity Tracker: Artificial Intelligence. https://cat.eto.tech/. All data from CSET’s Country Activity Tracker referenced in this report was last consulted in June 2023.

11 | Mozur, Paul and Metz, Cade. The New York Times (2021). “A U.S. Secret Weapon in A.I.: Chinese Talent.” April 13. https://www.nytimes.com/2020/06/09/technology/china-ai-research-education. html. Accessed: August 28, 2023.

12 | Bureau of Industry and Security, Commerce (2019). “Addition of Certain Entities to the Entity List.” Washington, D.C.: Federal Register 84(196): 54002-54009; Allen, Gregory C. Center for Strategic and International Studies (2022). “Chocking Off China’s Access to the Future of AI.” October 11. https:// www.csis.org/analysis/choking-chinas-access-future-ai. Accessed: August 15, 2023; The White House (2023). “President Biden Signs Executive Order on Addressing United States Investments In Certain National Security Technologies And Products In Countries Of Concern.” August 9. https://www. whitehouse.gov/briefing-room/statements-releases/2023/08/09/president-biden-signs-executive- order-on-addressing-united-states-investments-in-certain-national-security-technologies-and- products-in-countries-of-concern/. Accessed: August 10, 2023; Kaye, Kate. Protocol (2022). “Microsoft helped build AI in China. Chinese AI helped build Microsoft.” November 2. https://www.protocol.com/ enterprise/us-china-ai-microsoft-research. Accessed: August 29, 2023.

13 | Center for Security and Emerging Technology. Emerging Technology Observatory’s Country Activity Tracker: Artificial Intelligence. https://cat.eto.tech/.

14 | Alibaba Cloud (2018). “Alibaba Cloud Launches Cloud and AI Solutions at MWC in Europe.” February

28. https://www.alibabacloud.com/blog/blogblogalibaba-cloud-launches-cloud-and-ai-solutions-in-

europe-to-meet-changing-needs-in-digital-transformation_499249. Accessed: August 28, 2023; PR Newswire (2021). “InferVision AI Assists the European Commission Monitoring COVID-19 Variants.” August 16. https://www.prnewswire.com/il/news-releases/infervision-ai-assists-the-european-

commission-monitoring-covid-19-variants-301355844.html. Accessed: August 29, 2023.15 | Taylor, Phil. Pharmaphorum (2022). “Sanofi signs $1.2bn research alliance with AI specialist Insilico.” November 9. https://pharmaphorum.com/news/sanofi-signs-1-2bn-research-alliance-with- ai-specialist-insilico. Accessed: August 29, 2023; Graphcore (2021). “Graphcore poised for explosive growth in China with partner Digital China.” April 21. https://www.graphcore.ai/posts/graphcore- poised-for-explosive-growth-in-china-with-partner-digital-china. Accessed: August 29, 2023.

16 | Future of Life Institute (2022). “Emerging Non-European Monopolies in the Global AI Market.” November. https://futureoflife.org/wp-content/uploads/2022/11/Emerging_Non-European_ Monopolies_in_the_Global_AI_Market.pdf. Accessed: August 29, 2023.

17 | Hannas, William and Chang, Huey-Meei. Center for Security and Emerging Technology (2019). “China’s Access to Foreign AI Technology.” September. https://cset.georgetown.edu/publication/ chinas-access-to-foreign-ai-technology/. Accessed: August 29, 2023.

18 | European Commission (2023). “Commission Recommendation of 03 October 2023 on critical technology areas for the EU's economic security for further risk assessment with Member States.” October 3.. https://defence-industry-space.ec.europa.eu/document/download/31c246f2-f0ab-4cdf- a338-b00dc16abd36_en?filename=C_2023_6689_1_EN_ACT_part1_v8.pdf. Accessed: October 26, 2023.

19 | European Commission (2023). “An EU approach to enhance economic security.” June 20. https:// ec.europa.eu/commission/presscorner/detail/en/IP_23_3358. Accessed: August 29, 2023.

20 | Mozur, Paul. The New York Times (2019). “One Month, 500,000 Face Scans: How China Is Using A.I. to Profile a Minority.” April 14. https://www.nytimes.com/2019/04/14/technology/china-surveillance- artificial-intelligence-racial-profiling.html. Accessed: August 29, 2023; Healy, Conor (2021). “Uyghur Surveillance & Ethnicity Detection Analytics in China.” Expert Report Presented to the Uyghur Tribunal. London: Uyghur Tribunal. https://uyghurtribunal.com/wp-content/uploads/2021/09/Conor-Healy.pdf. Accessed: August 29, 2023; Mozur, Paul, Xiao, Muyi, and Liu, John. The New York Times (2022). “‘An Invisible Cage: How China Is Policing the Future.” June 25. https://www.nytimes. com/2022/06/25/technology/china-surveillance-police.html. Accessed: August 29, 2023.

21 | Knight, Will. Wired (2020). “MIT Cuts Ties With a Chinese AI Firm Amid Human Rights Concerns.” April 21. https://www.wired.com/story/mit-cuts-ties-chinese-ai-firm-human-rights/.

22 | Kjeldtoft, Sebastian S. Politiken (2020). “Aalborg Universitet har hjulpet omstridt kinesisk firma, der bidrager til forfølgelse og overvågning af millioner.” June 23. https://politiken.dk/udland/ int_kina/art7835507/Aalborg-Universitet-har-hjulpet-omstridt-kinesisk-firma-der-bidrager-til- forf%C3%B8lgelse-og-overv%C3%A5gning-af-millioner. Accessed: August 29, 2023; interview with expert with knowledge of Denmark’s research collaboration with and research security policy vis-à-vis China.

23 | Duehren, Andrew and Tracy, Ryan. The Wall Stret Journal (2023). “U.S. Grapples With Potential Threats From Chinese AI.” June 16. https://www.wsj.com/articles/u-s-grapples-with-potential-threats- from-chinese-ai-7d1f2e70. Accessed: August 29, 2023.

24 | For alternative approaches to identifying AI-relevant research, see: Schoeberl, Christian, Toney, Autumn, and Dunham, James. Center for Security and Emerging Technology (2023). “Identifying AI research.” July. https://cset.georgetown.edu/publication/identifying-ai-research/. Accessed: August 30, 2023.

25 | Importantly, the underlying frameworks, or the building blocks for designing, training, and verifying algorithms, have also been open sourced. As of June 2023, 60 percent of academic AI papers based on AI frameworks used Facebook’s PyTorch. Trends. Papers with Code. https://paperswithcode.com/ trends. Accessed: June 30, 2023.

26 | There are exceptions where classification of results may be required, such as with defense-relevant AI research that is EU-funded, or where companies prefer for their R&D outputs to remain proprietary. Meanwhile, there are signs that Big Tech is reconsidering the open-source foundation norm for fear of competition. Heaven. Will Douglas. MIT Technology Review (2023). “The open-source AI boom is built on Big Tech’s handouts. How long will it last?” May 12. https://www.technologyreview. com/2023/05/12/1072950/open-source-ai-google-openai-eleuther-meta/. Accessed: August 29, 2023.

27 | OECD (2019). “Measuring the Digital Transformation: A Roadmap for the Future.” Paris: OECD Publishing.

28 | Murdick, Dewey, Dunham, James, and Melot, Jennifer. Center for Security and Emerging Technology (2020). “AI Definitions Affect Policymaking.” June 2. https://cset.georgetown.edu/publication/ai- definitions-affect-policymaking/. Accessed: August 29, 2023.

29 | While we included 2022 numbers to observe any thematic or institutional trends in recently published papers, our results are current as of May 2023 and do not necessarily capture the full scope of European-Chinese AI research collaboration that occurred in 2022: OpenAlex, the open-source repository of scientific literature on which we relied for our analysis, may record some publications data with a delay.

30 | Chou, Daniel. Center for Security and Emerging Technology (2022). “Counting AI Research: Exploring AI Research Output in English- and Chinese-Language Sources.” July. https://cset.georgetown.edu/ publication/counting-ai-research/. Accessed: August 29, 2023.

31 | Righi, Riccardo, Lopez Cobo, Monstserrat, Samoili, Sofia et al. (2021). “EU in the global ArtificialIntelligence landscape.” JRC125613. Brussels: European Commission Joint Research Center.

32 | Interviews with representatives of two European companies that conduct AI R&D in China.

33 | Interview with the leadership of a technical university in Northern Europe.

34 | This is not surprising, as co-authored papers in general are cited more often. Thelwall, Mike, Kousha, Kayvan, Abdoli, Mahshid et al. ArXiv (2022). “Why are co-authored academic articles more cited: Higher quality or larger audience?” December 11. https://arxiv.org/ftp/arxiv/papers/2212/2212.06571.pdf. Accessed: August 29, 2023; Toney, Autumn and Flagg, Melissa (2021). “Research Impact, Research Output, and the Role of International Collaboration.” November. https://cset.georgetown.edu/publication/research-impact-research-output-and-the-role-of-international- collaboration/. Accessed: August 29, 2023.

35 | Authors’ analysis of OpenAlex data.

36 | Ibid.

37 | Ibid.

38 | For authoritative analyses of China’s strategic aims, policies, and progress with regard to the development and integration of AI technologies for military innovation, see, in particular: Kania, Elsa B. (2021). “Artificial intelligence in China’s revolution in military affairs.” Journal of Strategic Studies 44(4): 515-542; Kania, Elsa B. Brookings (2020). ““AI weapons” in China’s military innovation.” April. https://www.brookings.edu/articles/ai-weapons-in-chinas-military-innovation/. Accessed: August 29, 2023. On Military-Civil Fusion, see: Kania, Elsa B. and Laskai, Lorand (2021). “Myths and Realities of China’s Military-Civil Fusion Strategy.” https://www.cnas.org/publications/reports/myths- and-realities-of-chinas-military-civil-fusion-strategy. Accessed: August 29, 2023.

39 | The Federal Government (2023). “National Security Strategy.” Accessed: August 29, 2023.

40 | Nouwens, Meia and Legarda, Helena. Mercator Institute for China Studies (2018). “Emerging technology dominance: What China’s pursuit of advanced dual-use technologies means for the future of Europe’s economy and defence innovation.” December 19. https://merics.org/en/emerging- technology-dominance. Accessed: August 29, 2023.

41 | Millward, James and Peterson, Dahlia (2020). “China’s system of oppression in Xinjiang: How it developed and how to curb it.” September. https://www.brookings.edu/articles/chinas-system-of- oppression-in-xinjiang-how-it-developed-and-how-to-curb-it/. Accessed: August 29, 2023.

42 | Mazzocco, Ilaria. Big Data China, Center for Strategic and International Studies (2022). “The AI- Surveillance Symbiosis in China.” July 27. https://bigdatachina.csis.org/the-ai-surveillance-symbiosis- in-china/. Accessed: August 29, 2023; Baptista, Eduardo, Reuters (2022). “Insight: China uses AI software to improve its surveillance capabilities.” April 8. https://www.reuters.com/world/china/ china-uses-ai-software-improve-its-surveillance-capabilities-2022-04-08/. Accessed: August 29, 2023; Tiffert, Glenn and Stoff, Jeffrey. Hoover Institution (2021). “Eyes Wide Open: Ethical Risks In Research Collaboration With China.” December 15. https://www.hoover.org/press-releases/eyes-wide-open- ethical-risks-research-collaboration-china. Accessed: August 29, 2023.

43 | Kaye, Kate. Protocol (2022). “Will nationalism end the golden age of global AI collaboration?” November 1. https://www.protocol.com/enterprise/china-us-ai-open-source. Accessed: June 10, 2023; Kaye, Kate. Protocol (2022). “US policymakers could be alienating the Chinese AI researchers they want to attract.” November 2. https://www.protocol.com/enterprise/us-china-ai-researchers-talent. Accessed: June 10, 2023.

44 | Interview with European computer scientist.

45 | Sheehan, Matt, Kerry, Cameron F., and Meltzer, Joshua P. Brookings (2023). “Can Democracies Cooperate with China on AI Research?” January 9. https://carnegieendowment.org/ publications/88777. Accessed: May 15, 2023. https://www.brookings.edu/articles/can-democracies- cooperate-with-china-on-ai-research/.

46 | Groenewegen-Lau, Jeroen and Laha Michael. Mercator Institute for China Studies (2023). “Controlling the innovation chain: China’s strategy to become a science & technology superpower.” February 2. https://merics.org/en/report/controlling-innovation-chain. Accessed: August 29, 2023.

47 | Kania, Elsa B. and Costello, John (2020). “Seizing the commanding heights: the PLA Strategic Support Force in Chinese military power.” Journal of Strategic Studies 44(2): 218-264.

48 | Tsinghua University. Australian Strategic Policy Institute. China Defence University Tracker. https:// unitracker.aspi.org.au/universities/tsinghua-university. Accessed: August 29, 2023.

49 | Xi’An University of Posts and Telecommunications. Australian Strategic Policy Institute. China Defence University Tracker. https://unitracker.aspi.org.au/universities/xian-university-of-posts-and- telecommunications/. Accessed: August 29, 2023.

50 | Interview with expert with knowledge of Denmark’s research collaboration with and research security policy vis-à-vis China.

51 | Interview with export controls compliance officer at a European university.

52 | Since we were interested in identifying investments in AI companies, we excluded large, publicly traded firms from our analysis as it would be impossible to know whether a given transaction went to their AI-focused divisions, or to other areas of their business. This makes our results more accurate.

53 | Lysenko, Adam, Hanemann, Thilo, and Rosen, Daniel H. Rhodium Group (2020). “Disruption: US- China Venture Capital in a New Era of Strategic Distrust.” January 13. https://rhg.com/research/ disruption-us-china-venture-capital-in-a-new-era-of-strategic-distrust/. Accessed: August 29, 2023.

54 | Business Wire (2021). “Exscientia Announces Investment of up to $525M.” April 21. https://www. businesswire.com/news/home/20210427005905/en/Exscientia-Announces-Investment-of-up-to-525M. Accessed: August 29, 2023; Hongyou Investment. Deep Knowledge Analytics. https:// mindmaps.dka.global/firms/71106. Accessed: August 29, 2023.

55 | Market Screener (2021). “German-Chinese startup Agile Robots raises $220 million from investors.” September 9. https://www.marketscreener.com/quote/stock/XIAOMI-CORPORATION-45271958/ news/German-Chinese-startup-Agile-Robots-raises-220-million-from-investors-36387152/. Accessed: August 29, 2023.

56 | Holzki, Larissa and Votsmeier, Volker, Handelsblatt (2021). “Millionen für Agile Robots: Deutschland hat jetzt auch ein Roboter-Einhorn. ” September 13. https://www.handelsblatt.com/ technik/milliardenbewertung-millionen-fuer-agile-robots-deutschland-hat-jetzt-auch-ein-roboter- einhorn/27597954.html. Accessed: August 29, 2023.

57 | TechNode (2023). “Lenovo invests in foundational large model company reInventAI.” July 14, 2023. https://technode.com/2023/07/14/lenovo-invests-in-foundational-large-model-company-reinventai/. Accessed: July 25, 2023.

58 | Lenovo Group is a publicly listed company that spun out of the state-owned Chinese Academy of Sciences’s Institute of Computing Technology in 1984. As of December 2022, CAS was still a beneficial owner with 29 percent of the shares in Legend Holdings (联想控股), Lenovo’s parent company. Legend Holdings (2022). “2022 Annual Report.” http://ir.legendholdings.com.cn/media/1197/2022-annual-report-e.pdf. Accessed: August 15, 2023.

59 | For in-depth analysis of China’s government-backed AI-brain research program, including its objectives and institutions, as well as efforts in neuromorphic computing research and as the role of foreign expertise in their realization, see: Hannas, William, Chang, Huey-Meei, Aiken, Catherine et al. Center for Security an Emerging Technology (2020). “China AI-Brain Research: Brain-Inspired AI, Connectomics, Brain-Computer Interfaces.” September. https://cset.georgetown.edu/publication/ china-ai-brain-research/. Accessed: August 29, 2023; Hannas, William C. and Chang, Huey-Meei (2021). “China’s “New Generation” AI-Brain Project.” PRISM 9(3). https://ndupress.ndu.edu/Media/News/News-Article-View/Article/2846343/chinas-new-generation-ai-brain-project/. Accessed: August 29, 2023; Hannas, William, Chang, Huey-Meei, Chou, Daniel and Fleeger, Brian. Center for Security an Emerging Technology (2022). “China’s Advanced AI Research: Monitoring China's Paths to “General” Artificial Intelligence.” https://cset.georgetown.edu/publication/chinas-advanced-ai-research/. Accessed: August 29, 2023.

60 | Kaye, Kate. Protocol (2022). “Kai-Fu Lee wanted to teach the US about Chinese AI. Instead he provoked a rivalry.” November 7. https://www.protocol.com/enterprise/kai-fu-lee-china-ai. Accessed: August 29, 2023.

61 | Prophesee (2021). “Prophesee announces strategic investment from leading AI investor Sinovation Ventures to accelerate commercialization of neuromorphic vision sensing platform.” July 6. https:// www.prophesee.ai/2021/07/06/strategic-investment-sinovation-xiaomi-inno-chip/. Accessed: August 29, 2023.

62 | Memory technologies with multi-scale time constants for neuromorphic architectures. Community Research and Development Information Service (CORDIS). https://cordis.europa.eu/project/ id/871371. Accessed: August 30, 2023; Clarke, Peter. eeNews Analog (2021). “Prophesee, SynSense form vision computing partnership.” November 26. https://www.eenewseurope.com/en/ prophesee-synsense-form-vision-computing-partnership/. Accessed: August 30, 2023; Koslowski, Anne. Switzerland Global Enterprise (2023). “SynSense presents new robot and receives millions from China.” April 21. https://www.s-ge.com/en/article/news/20232-robotics-synsense-new- robot?ct. Accessed: August 30, 2023; Contact Us (联系我们). Synsense. https://web.archive.org/ web/20230808121504/https://www.synsense.ai/zh-hans/contact/. Accessed: August 30, 2023.

63 | About us. Synsense. https://www.synsense.ai/about-us/. Accessed: August 30, 2023; Joske, Alex (2019). “The company with Aussie roots that’s helping build China’s surveillance state.” August 26. https://www.aspistrategist.org.au/the-company-with-aussie-roots-thats-helping-build- chinas-surveillance-state/; Human Rights Watch (2019). “China’s Algorithms of Repression: Reverse Engineering a Xinjiang Police Mass Surveillance App.” May 1. https://www.hrw.org/ report/2019/05/01/chinas-algorithms-repression/reverse-engineering-xinjiang-police-mass. Accessed: August 30, 2023.

64 | Weinstein, Emily S. and Luong, Ngor. Center for Security and Emerging Technology (2023). “U.S. Outbound Investment into Chinese AI Companies.” February. https://cset.georgetown.edu/ publication/u-s-outbound-investment-into-chinese-ai-companies/. Accessed: June 27, 2023.

65 | Baigorri, Manuel and Chan, Vincy. Bloomberg (2021). “China’s Didi Raises $1.5 Billion in Debt Ahead of IPO.” April 9. https://www.bloomberg.com/news/articles/2021-04-09/china-s-didi-is-said-to-raise- 1-5-billion-in-debt-ahead-of-ipo#xj4y7vzkg. Accessed: August 30, 2023.

66 | Fintech Global (2020). “Cybersecurity company Marknum closes $14m round.” May 4. https://fintech. global/2020/05/04/cybersecurity-company-marknum-closes-14m-round/. Accessed: August 30, 2023.

67 | Marknum Technology (吗牛科技). https://archive.is/YI13S. Accessed: June 20, 2023.

68 | Intelligence Online (2021). “Alpha Intelligence Capital invests in European and Chinese cyber intelligence.” June 25. https://www.intelligenceonline.com/surveillance--interception/2021/06/25/ alpha-intelligence-capital-invests-in-european-and-chinese-cyber-intelligence,109675683-art. Accessed: August 30, 2023.

69 | Bosch (2021). “Robert Bosch Venture Capital establishes Boyuan Capital to expand its investment coverage in China.” September 27. https://www.bosch-presse.de/pressportal/de/en/robert-bosch- venture-capital-establishes-boyuan-capital-to-expand-its-investment-coverage-in-china-233344.html. Accessed: August 30, 2023.

70 | WeRide (2022). “WeRide and Bosch Jointly Develop Advanced Driving Solution in China.” May 25. https://werideai.medium.com/weride-received-strategic-investment-from-bosch-14cf13b0bbbb. Accessed: August 30, 2023.

71 | SingGo Technology WeChat Account (2022). “Cambricon SingGo receives investment by Bosch Group to help the development of autonomous driving industry (寒武纪行歌获博世创业投资公司投资,携手助力自动驾驶产业发展).” https://archive.is/yNw1D. Accessed: August 30, 2023.

72 | O’Farrell, Seth. fDi Intelligence (2023). “Bosch pours $1bn into automotive R&D in China.” March 8. https://www.fdiintelligence.com/content/feature/bosch-pours-1bn-into-automotive-rd-in-china-81990. Accessed: August 30, 2023.

73 | Zhang, Lilian. South China Morning Post (2023). “China’s AI chip champion Cambricon downsizes autonomous driving unit as it struggles to make a profit.” July 28. https://www.scmp.com/tech/big- tech/article/3229277/chinas-ai-chip-champion-cambricon-downsizes-autonomous-driving-unit-it- struggles-make-profit. Accessed: August 30, 2023.

74 | Webster, Graham, Creemers, Rogier, Kania, Elsa et al. (2017). “Full Translation: China’s ‘New Generation Artificial Intelligence Development Plan’ (2017).” August 1. https://digichina.stanford. edu/work/full-translation-chinas-new-generation-artificial-intelligence-development-plan-2017/. Accessed: August 30, 2023.

75 | Li, Fei-Fei. Google Blog (2017). “Opening the Google AI China Center.” December 13. https://blog. google/around-the-globe/google-asia/google-ai-china-center/. Accessed: August 30, 2023; Synced (2021). “IBM Closes China Research Laboratory.” January 25. https://syncedreview.com/2021/01/25/ ibm-closes-china-research-laboratory/. Accessed: August 30, 2023.

76 | Hardman, Lynda (2020). “Artificial Intelligence along the New Silk Road: Competition or Collaboration?” In Marijk van der Wende et al. (eds.). China and Europe on the New Silk Road: Connecting Universities Across Asia, 240-254. Oxford: Oxford University Press.

77 | The lab was previously known as the Sino-French Laboratory for Computer Science, Automation and Applied Mathematics. Sino-French Laboratory for Computer Science, Automation and Applied Mathematics (中法信息、自动化与应用数学联合实验室). Institute of Automation. Chinese Academy of Sciences. https://archive.is/5nXz5. Accessed: June 17, 2023.

78 | Ambassade de France en Chine. “Information and Communications Technology (信息和通信技术).” Factsheet retrieved from the embassy’s website. https://cn.ambafrance.org/IMG/pdf/stic-3. pdf. Accessed: February 21, 2023; Chinese Academy of Sciences (2017). “China, France and the Netherlands Agree to Further Strengthen Cooperation on Information Technology and Artificial Intelligence.” July 12. https://archive.ph/4TNXa#selection-395.258-395.358. Accessed: October 3, 2022; The Sino-French Laboratory in Computer Science, Automation and Applied Mathematics. Chinese Academy of Sciences. https://archive.is/jg3gy. Accessed: June 17, 2023; Institute of Automation, Chinese Academy of Sciences (2018). “The Institute of Automation promoted the signing of a strategic cooperation agreement on artificial intelligence between the Chinese Academy of Sciences and the French Institute of Information and Automation (自动化所推动中科院和法国信息与自动化研究院签署人工智能战略合作协议).” April 19. https://archive.ph/FoXlr. Accessed: October 3, 2022; Institute of Automation, Chinese Academy of Sciences (2019). “The Sino-European Laboratory for Computer Science, Automation and Applied Mathematics held a symposium on artificial intelligence technology in France (中欧信息、自动化与应用数学联合实验室在法召开人工智能技术研讨会).” November 4. https://archive.ph/hXpAK. Accessed: August 30, 2023.

79 | “China, France and the Netherlands Agree to Further Strengthen Cooperation on Information Technology and Artificial Intelligence.” July 12. https://archive. ph/4TNXa#selection-395.258-395.358. Accessed: October 3, 2022.

80 | Inria (2023). “The Associate Teams 2024 call for proposals is open!” June 29. https://www.inria.fr/en/ call-for-projects-international-partnerships-associate-teams-2024. Accessed: June 29, 2023; Institute of Automation, Chinese Academy of Sciences (2019). “The Sino-European Laboratory for Computer Science, Automation and Applied Mathematics held a symposium on artificial intelligence technology in France (中欧信息、自动化与应用数学联合实验室在法召开人工智能技术研讨会).” November 4. https:// archive.ph/hXpAK. Accessed: August 30, 2023; Inria (2019). “The 2019 LIAMA Workshop.” https://archive.is/5xgek. Accessed: May 10, 2023.

81 | A lecture series on these topics was organized in 2021, suggesting the network was still active at that time. Institute of Automation, Chinese Academy of Sciences (2021). “Lecture Series of LIAMA - Weak Visual Biometric Signal Analysis and Recognition.” October 21. https://archive.is/b1IVb. Accessed: June 19, 2023.

82 | Tiffert, Glenn and Stoff, Jeffrey. Hoover Institution (2021). “Eyes Wide Open: Ethical Risks In Research Collaboration With China.” December 15. https://www.hoover.org/press-releases/eyes-wide-open- ethical-risks-research-collaboration-china. Accessed: August 29, 2023.