Green technology

Over the past two decades, China has become the global leader in manufacturing green technologies. It occupies dominant positions in the supply chains for solar, wind, batteries, and new energy vehicles. As the largest investor in related manufacturing capacity, China accounted for three-quarters of investment in clean technology production in 2023.

In the eyes of Chinese policymakers, green technologies serve the twin purposes of stimulating economic growth and facilitating the country’s decarbonization. Products such as solar panels and batteries drive growth in exports, and China is investing heavily in its own renewable energy capacity.

Estimates suggest China will account for almost 60 percent of new renewable capacity installed globally between 2023-2028.

Robust market competition and state support have bolstered China’s green tech industries. Private firms such as LONGi, Mingyang, CATL and BYD demonstrate the important role of entrepreneurs in the sector’s success. However, the Chinese government has also provided significant financial support and a home market advantage to local players.

Foreign countries benefit from cheap imports of green technologies, but China's dominance also poses strategic risks. Overdependencies increase the likelihood of China exerting economic coercion and the potential for costly supply chain disruptions. Competition from China also undermines Europe’s industrial ambitions in green technologies.

At a glance

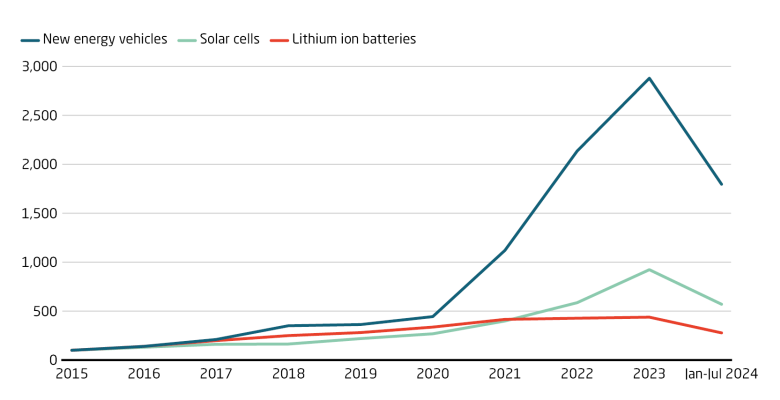

Green technology output, in particular new energy vehicles (NEVs), has grown considerably thanks to growing demand and government support for low carbon industries. Between 2020 and 2023, the number of NEVs made in China grew from 1.5 million to 9.4 million, accounting for almost a third of all cars produced in the country.

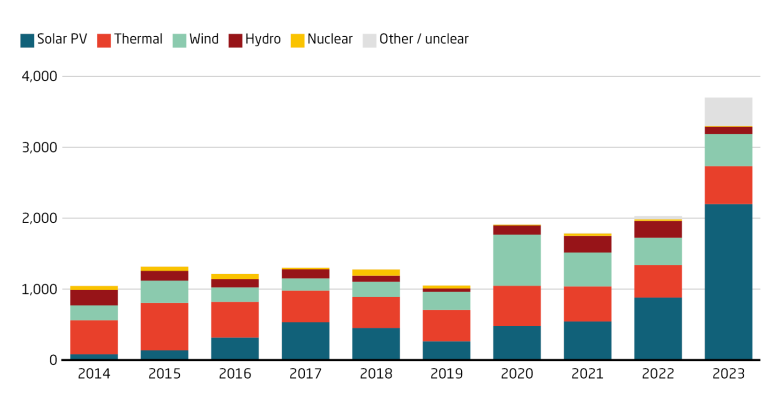

China’s solar PV installations grew at breakneck speed in 2022 and 2023 due to a drop in equipment prices and government backing. The country is on track to reach its target of installing 1,200 GW of wind and solar capacity by the end of 2024, six years early. At the end of 2023, EU wind and solar capacity amounted to just 481 GW.

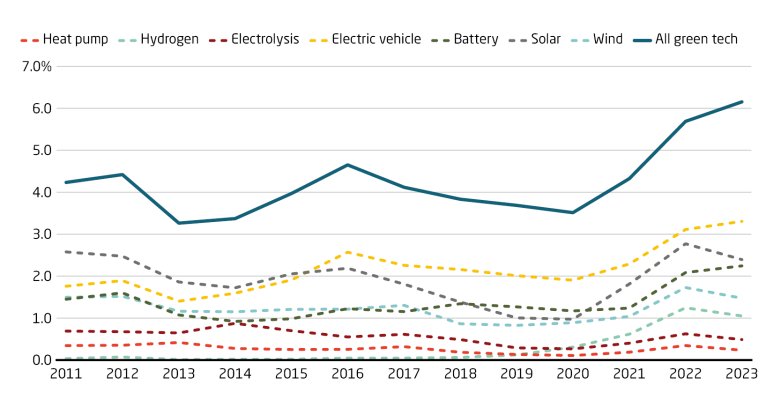

Policy documents show China’s increased focus on green technologies. Documents mentioning electric vehicles, solar and battery lead the pack, corresponding to the prized “New Three” exports. Wind energy follows, with almost 1.5 percent of mentions in 2023. Green hydrogen has appeared more since 2018, indicating a new area of focus.

Green technology in China: Timeline of crucial events

China Society of Automotive Engineers releases the Energy Saving and NEV Tech Roadmap 2.0, aiming for new energy vehicles (NEVs) to comprise 50 percent of new car sales by 2035.

China implements a nationwide carbon trading market, starting with the power sector. Initially covering 4.5 billion tons of CO2, it is now the biggest carbon market worldwide.

China’s renewable energy capacity exceeds 1,000 gigawatts – an energy transition milestone. Renewables make up 44.8 percent of capacity, with hydropower the largest at 37 percent of all renewables.

The NDRC releases the 14th Five Year Plan for renewable energy. Renewables will make up at least half of electricity generation capacity added in 2021-2025. The plan aims to double solar and wind.

Sinopec completes China's largest green hydrogen plant in Kuqa, Xinjiang, using photovoltaic power. It will reduce CO2 emissions by 485,000 tons annually by replacing hydrogen from natural gas.

China’s largest electric vehicle maker BYD says it will build a car factory in Szeged, Hungary. Its first in Europe, the plant is expected to create thousands of local jobs.

Wind and solar energy capacity surpasses coal for the first time. Non-fossil sources now make up over half of total capacity. But coal still comprised 60 percent of power generated in 2023.

Firms led by state-owned China Energy Investment Corp. Ltd create a CNY 10 billion (EUR 1.3 billion) fund for new energy technologies &projects, encompassing solar, wind &hydrogen-based technologies.

Xi Jinping says China aims to reach peak carbon emissions by 2030 & carbon neutrality by 2060. The 2060 target is ten years later than the G7, EU, South Korea & Brazil and 10 years earlier than India.

The National Development and Reform Commission (NDRC) releases a strategy to develop the hydrogen sector by 2035, focusing on the transport, energy storage, power and industrial sectors.

The government extends its 2014 tax exemption policy to promote EVs. EV sales are exempt from the vehicle purchase tax until the end of 2025, and must only pay half until the end of 2027.

Ningbo Shanshan, the world's largest supplier of electric car battery materials says it will build a new plant in Finland. The plant will serve Western and Central Europe.

People’s Daily reports: In 2023 Chinese shipbuilders received over half of all global orders for low carbon &pollution ships. An official says China will pursue policies to support green shipbuilding.

The Ministry of Industry and Information Technology issues draft rules to raise the capital ratio for solar PV manufacturing projects and need plants to operate at least 50 percent of annual capacity.

Tech progress

- China overtook Denmark as the world leader in wind turbine patents in 2023. Chinese firms are looking to expand their 60 percent global market share as the US and Europe move to protect their industries. (Source (EN): Nikkei Asia)

Domestic dynamics

- Construction began on China's largest offshore photovoltaic power station to date. The 2 GW offshore power station is being built by China National Nuclear Power in Jiangsu Province. (Source (CN): S&T Daily)

- China’s Ministry of Industry and Information Technology (MIIT) released draft rules raising, the minimum capital ratio for solar PV manufacturing projects. The measures aim to limit new investments in the government-backed sector, as it faces overcapacity. (Source (CN): MIIT)

- In July, both Jinko Solar and Trina Solar terminated plans to raise money for capacity expansion. Heavy investment in the sector has led to a stark reduction in prices for solar modules and eroded profit margins. (Source (CN): Xinhua)

Foreign involvement

- Chinese EV manufacturers are expanding into African and Middle Eastern markets. The emerging "Nezha Automobile (NETA)" entered Kenya, and Xpeng Motors launched new cars in Egypt. (Source (CN): 36kr)

- Jinko Power Technology announced plans to sell its Antequera solar farm project in Spain. The firm will sell the 175 MW solar project to a Hong Kong-based subsidiary of Chinese hydropower titan China Huadian, a state-owned company. (Source (CN): 36kr)